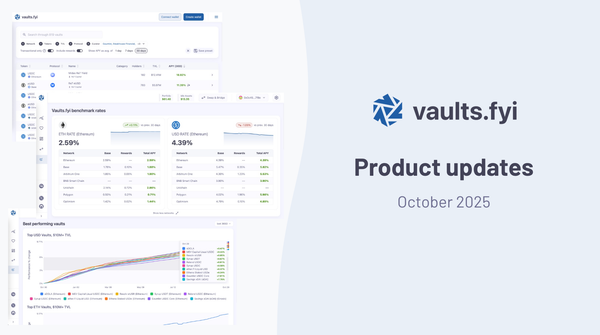

October Changelog

Check out our new network-specific benchmark yields, Solana API endpoints, and features around curators.

Check out our new network-specific benchmark yields, Solana API endpoints, and features around curators.

From deeper API insights to a faster app experience and support for even more protocols, our team has been shipping new features and upgrades to make the vaults.fyi app and API even more powerful.

Last updated: October 2 2025 At vaults.fyi, we track yields across every major DeFi protocol, network, and asset — all in one place. This page is your definitive reference for current DeFi vaults, with transparent, on-chain data you can verify yourself. Whether you’re a DeFi power user or just

We’re excited to announce that infiniFi is now integrated on vaults.fyi, with full analytics and transactional support for Staked infiniFi USD (siUSD). This integration brings infiniFi’s high-efficiency stablecoin yield vaults into the vaults.fyi ecosystem, enabling onchain users to analyze, compare, and interact with infiniFi vaults directly

Tokemak Autopools are now available via the vaults.fyi app and API. Users can now access our complete suite of tools, from advanced analytics to seamless transactions and position tracking, for Tokemak Autopools on Ethereum and Base.

The DeFi landscape for stablecoin yields is undergoing a profound transformation. A more mature, resilient, and institutionally-aligned ecosystem is emerging. Our recent report with Artemis.xyz unpacks key trends shaping onchain stablecoin yields.

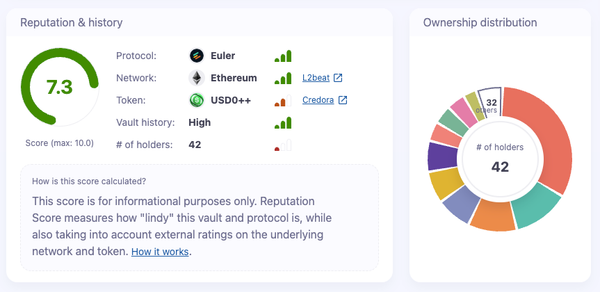

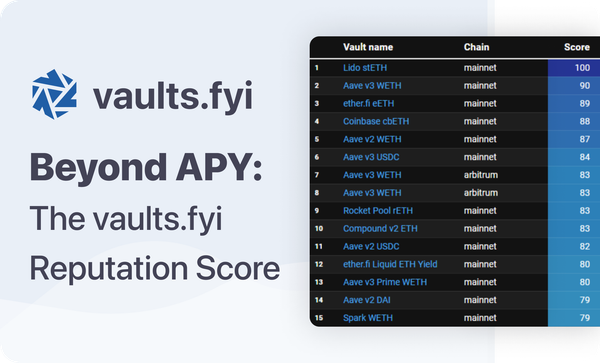

Reputation Scores help users navigate onchain yields. Our scores provide more transparency and clarity on each vault's track record, underlying asset quality, and chain security. Now available in both the vaults.fyi app and API.

Building DeFi integrations is a path fraught with hidden costs, immense complexity, and strategic dead ends. Instead of trying to become experts in the arcane complexities of multi-chain DeFi data, you can leverage a single, powerful API to achieve a better result in a fraction of the time.

We’re excited to share that vaults.fyi now supports Berachain and we’ve integrated directly with two of its premier DeFi protocols: Euler and Dolomite. These integrations make it easier than ever to explore, compare, and deploy to high-quality Berachain vaults — all from the vaults.fyi dashboard or via

We’re excited to announce that World Chain — the human-first Ethereum Layer 2 developed by World (formerly Worldcoin) — is now integrated with vaults.fyi! This marks the start of a new frontier for DeFi users seeking yield opportunities in sybil-resistant, identity-verified ecosystems. Today, you can access Morpho vaults for USDC.

The vaults.fyi API suite powers real-time, onchain analytics for DeFi yield opportunities and transactional capabilities across leading protocols. In this case study, we explore how Etherscan—Ethereum’s go-to block explorer—leveraged both our Insights API and Earn API to enhance the user experience with the Etherscan Cards integration.

API updates, Multi-step supply flow, Aave on Gnosis, Lido (w)stETH, MCP Claude & More Several updates are live on vaults.fyi this week. We’ve been hard at work improving the app and API products to make connecting with DeFi yields even smoother. Here’s what’s new: 🔌 API

Several updates are live on app.vaults.fyi this week. We’ve been hard at work improving the app to make discovering and interacting with DeFi vaults even smoother.

We’re thrilled to announce that Swellchain — including the powerful integration with Euler — is now available on vaults.fyi! This latest addition opens up even more high-quality opportunities for DeFi users to earn yield, this time on one of the most innovative Ethereum L2s focused on restaked assets and stablecoin-native

In DeFi, “APY” (annual percentage yield) can be a confusing metric and sometimes outright deceiving. Let’s take an example: A vault might advertise a 30% APY, but after you deposit and go to withdraw months later, you realize you earned about 1/4 of that. What happened? At vaults.

Insights

A look at the top DeFi opportunities: * Looking at this week's yields on the vaults.fyi app, Revert Lend USDC leads again with 16.92% APY. Savings USDS maintains 12.50% APY via the Sky Savings Rate on both mainnet and Base. Gauntlet USDC Core and Ethena Staked

Insights

A look at the top DeFi opportunities: * Looking at the vaults.fyi app's current yields, Revert Lend USDC leads the pack at 14.89% APY, followed closely by Gauntlet USDC Core at 14.67%. Savings USDS shows strong performance across both mainnet and Base at 12.50% APY,

Insights

A look at the top DeFi opportunities: * Big news this week as we launched the vaults.fyi app! Now you can discover yields, deposit funds, and track positions in one place. The app is fully non-custodial with no wrappers or extra smart contracts -- just connect your wallet and start

Product

Today we're launching app.vaults.fyi — transforming how users interact with DeFi yields. While our dashboard has become an industry standard for DeFi analytics, this release evolves vaults.fyi into an app where you can discover yields, deposit funds, and track positions in one place 👇 The problem DeFi

Insights

A look at the top DeFi opportunities: * Euler Finance sweeps the yield rankings this week, with their recently introduced 'Euler Yield' vaults claiming multiple top spots. APYs range from 23% to 53%, with their FDUSD vault leading with 53.35% APY 👇 * Morpho vaults again dominate the >$50M

Insights

A look at the top DeFi opportunities: * Two vaults from Euler Finance featuring the M token from M^0 take the top spots on vaults.fyi with 64.17% and 48.52% APY. Vaults from Seamless and Convex Finance continue their recent performance with APYs of ~28%. * Blue-chip USD yields

Insights

A look at the top DeFi opportunities: * Swaap Lend USDC and Apostro Resolv USDC, both vaults on Euler’s v2 protocol, top the vaults.fyi yield rankings with 38.28% and 38.08% APY respectively. Following the recent introduction of EUL rewards on vaults.fyi, many Euler vaults have been

In the wild west of onchain yield, investors are drowning in options but starving for trust. Onchain earning shouldn't be a solo expedition into the unknown. The vaults.fyi Reputation Score we introduce today is a tool designed to cut through the noise—transforming the complex history and

Insights

A look at the top DeFi opportunities: * ETH yields are up following recent positive sentiment and price action. Seamless Finance’s ILM 3x Loop wstETH/ETH vault provides the top APY at 40.81%, followed by Yearn’s yPT-agETH at 11.83%. The remainder of the top 10 are Morpho