Onchain Yields: Insights from our Report with Artemis.xyz

The DeFi landscape for stablecoin yields is undergoing a profound transformation. A more mature, resilient, and institutionally-aligned ecosystem is emerging. Our recent report with Artemis.xyz unpacks key trends shaping onchain stablecoin yields.

Last month, vaults.fyi partnered with blockchain analytics platform Artemis.xyz to publish an in-depth reserach report titled Onchain Yields: What the Data Shows & What's Next.

Our report unpacks critical trends shaping the evolution of DeFi and onchain yields. We highlight case studies that we believe are relevant to institutions, fintechs, and sophisticated investors looking to approach the space.

For media coverage of the Onchain Yields report, see articles from Coindesk, DL News, and The Block.

Key takeaways from the report

Institutional Adoption is Here and Growing

While nominal yields have recalibrated, institutional appetite for onchain financial infrastructure is building quiet momentum. The proof is in the numbers:

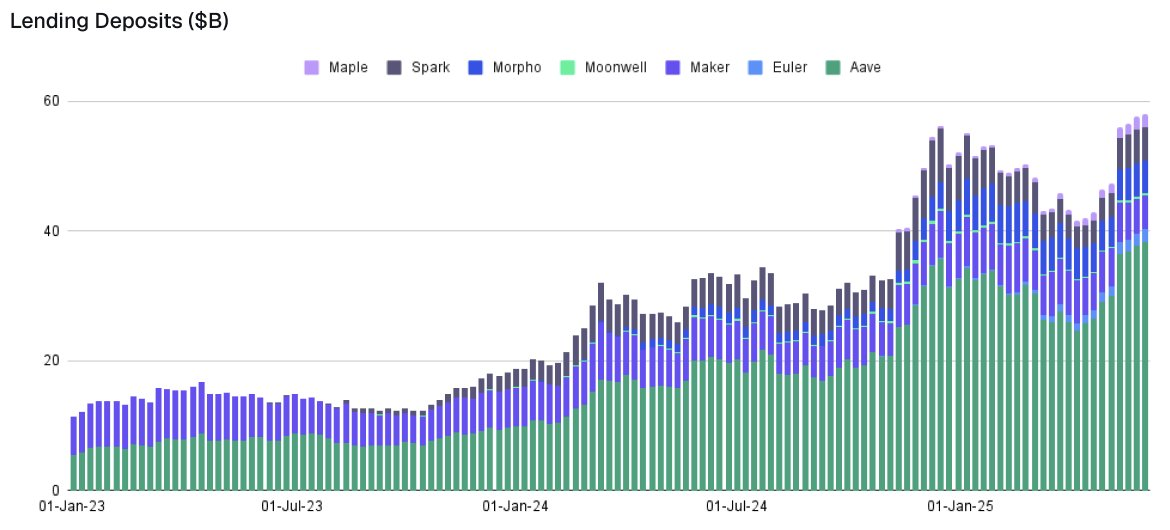

- Deposits are surging: Onchain lending markets have seen deposits grow by over 60% year-over-year.

- Significant capital is onchain: As of June 2025, leading collateralized lending platforms like Aave, Spark, and Morpho collectively held over $50 billion in Total Value Locked (TVL).

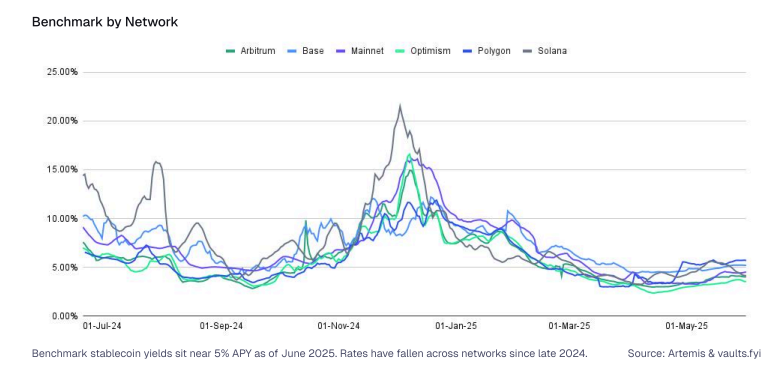

- Competitive, transparent yields: 30-day yields on USDC across these platforms ranged from 4% to 9%, rates that were broadly at or above traditional benchmarks like 3-month U.S. Treasury bills (~4.3% at the time).

The attraction for institutions goes beyond surface-level yield. The core appeal lies in the unique advantages of DeFi's infrastructure: 24/7 global markets, near-instant atomic settlement, and composable smart contracts that enable sophisticated, automated financial strategies.

The Foundations of Yield are Diversifying

Understanding onchain yields requires looking at the diverse, increasingly sophisticated "money lego" primitives that generate them. The report highlights four key pillars:

- Collateralized Lending: This foundational layer, pioneered by protocols like Aave and Compound, has evolved. Innovators like Morpho and Euler are now offering modular and isolated lending markets, allowing for customized and risk-managed vaults.

- Tokenized Real-World Assets (RWAs): The value of onchain U.S. Treasuries surged from $4 billion to over $7 billion in the first half of 2025. Platforms like Ondo Finance and Securitize are turning traditional fixed-income yields into programmable, onchain components that bring a new level of stability and familiarity to DeFi.

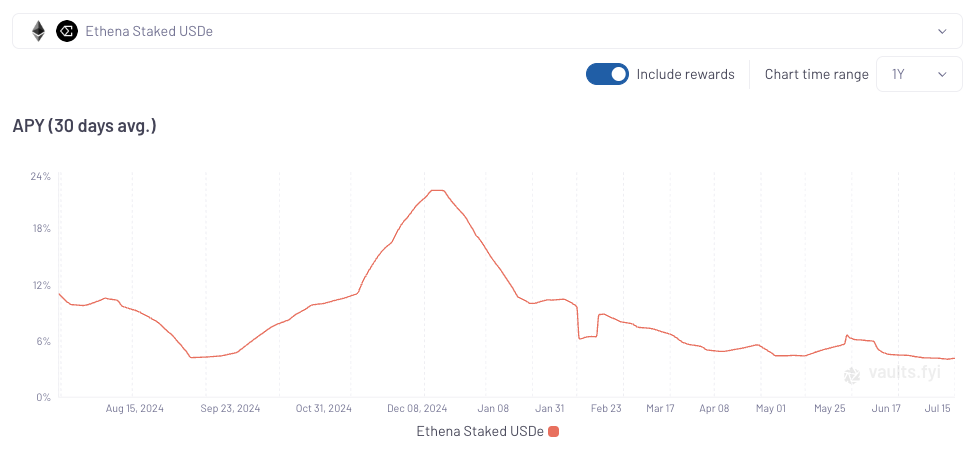

- Yield-Bearing Stablecoins (YBS): A new wave of stablecoins with native yield mechanisms has arrived. Ethena's sUSDe, for example, generates yield via a "cash and carry" trade on ETH, with some YBS protocols delivering yields between 6-10% in recent months.

- Yield Trading Markets: Pendle, which has surpassed $4 billion in TVL, is at the forefront of this innovation. It allows users to split yield-bearing assets into Principal and Yield Tokens, effectively creating fixed and floating rate instruments and adding a new layer of financial tooling to DeFi.

Users Prioritize More Than Just Yield

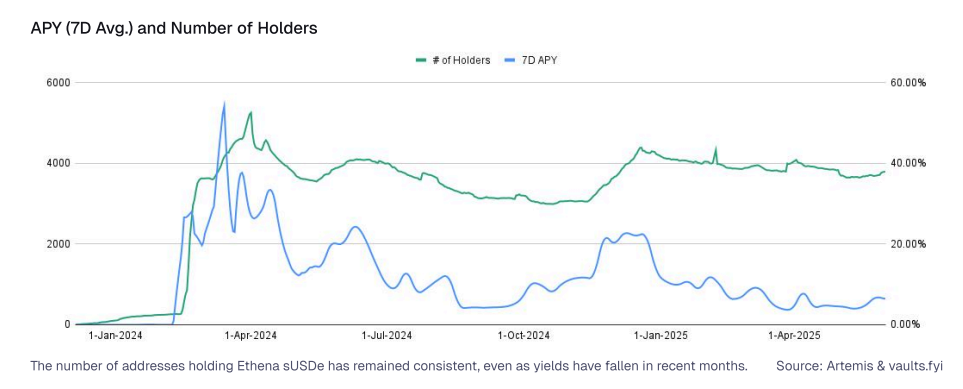

As the market matures, so does its user base. Data shows that chasing the highest APY is no longer the only game in town. Users are increasingly weighing reliability, predictability, and user experience (UX) when allocating capital.

- A Flight to Trust: During market volatility, capital consistently rotates toward established "blue-chip" lending protocols and RWA vaults, even if their yields are lower.

- "Stickiness" Beyond APY: The number of addresses interacting with select blue-chip protocols has remained consistent, even as yields have fallen. This demonstrates that trust in a protocol and its strategy can be a more powerful retainer than a high but volatile yield.

How Fintechs and Institutions Use Onchain Infrastructure

For fintechs and neobanks, the evolution of onchain yields unlocks direct pathways to new revenue streams and enhanced product offerings. Fintechs and exchanges are now offering noncustodial borrowing against crypto assets like BTC and ETH via embedded DeFi protocols.

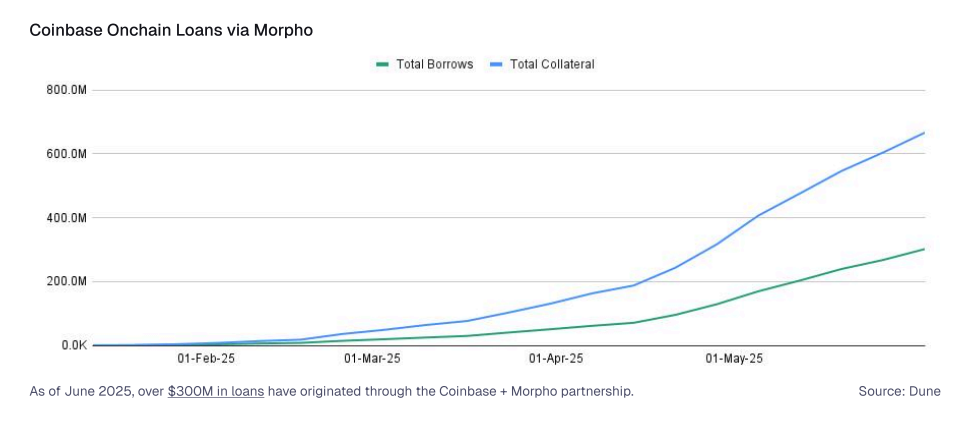

As an example, Coinbase has partnered with onchain protocol Morpho and has originated >$300M in loans onchain as of June 2025. This structure allows Coinbase users to borrow seamlessly against BTC holdings, powered by Morpho’s backend infrastructure.

Navigating a Cross-Chain World Requires Data

Yields for the same asset can vary significantly across different blockchains. In June 2025, average lending yields on Ethereum were around 4.8%, while Polygon returned 5.6%. While capital is becoming more adept at flowing between networks to capture these gaps, this optimization comes with its own risks, such as bridging security and slippage.

Our mission at vaults.fyi is to help teams navigate onchain yields with high-integrity data. We offer a single point of access to 500+ yields strategies across >10 networks, standardizing performance and risk metrics to empower reliable decision-making. By combining our data on yields with broader market metrics from Artemis, we help users get a comprehensive picture of capital flows, liquidity cycles, and true risk-adjusted performance.

For complete analysis, download the full report.

To learn more about how vaults.fyi can help your team approach onchain yields, explore our API or meet with us.