Stop Building DeFi Integrations. Start Shipping Features.

Building DeFi integrations is a path fraught with hidden costs, immense complexity, and strategic dead ends. Instead of trying to become experts in the arcane complexities of multi-chain DeFi data, you can leverage a single, powerful API to achieve a better result in a fraction of the time.

The opportunity is clear: your users want access to the high-yield opportunities in decentralized finance (DeFi). As a forward-thinking fintech, wallet, or exchange, offering seamless access to DeFi yields isn't just a feature—it's a strategic imperative to drive engagement, attract new users, and open up powerful revenue streams.

The immediate question for your product and engineering teams is: "Should we build it ourselves?"

While the impulse to build a proprietary solution is understandable, it’s a path fraught with hidden costs, immense complexity, and strategic dead ends. Before you dedicate a single sprint to in-house DeFi integration, you need to look past the initial build and consider the true, long-term cost of ownership.

At vaults.fyi, we provide the infrastructure to embed DeFi seamlessly into your platform. We’ve seen firsthand the challenges companies face, and we want to share why a partnership approach is not just easier, but smarter.

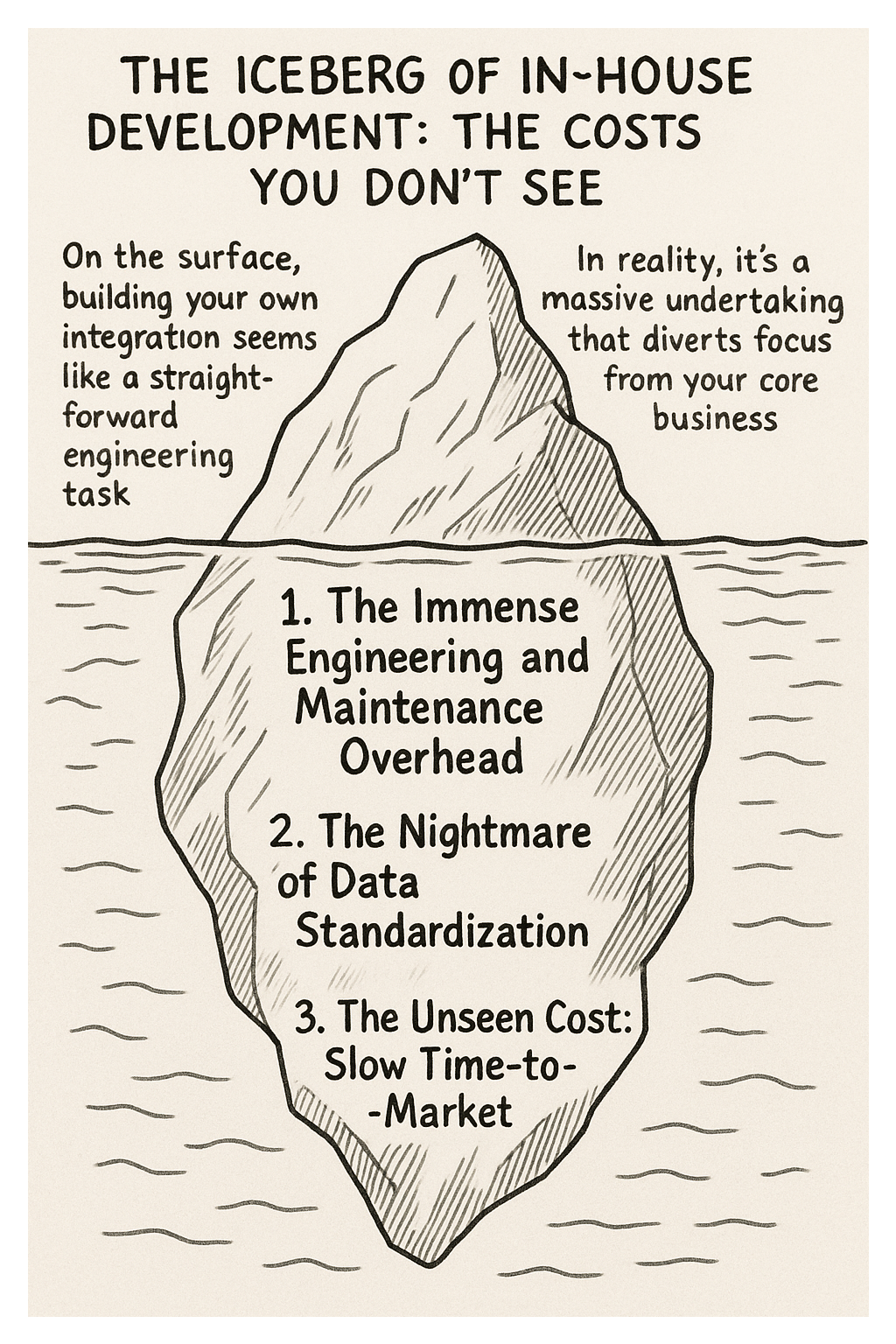

The Iceberg of In-House Development: The Costs You Don't See

On the surface, building your own integration seems like a straightforward engineering task. In reality, it's a massive undertaking that diverts focus from your core business.

1. The Immense Engineering and Maintenance Overhead

To offer yield from just a handful of top protocols across a few blockchains, you would need to commit to:

- A Dedicated, Expensive Team: You’ll need to hire—and retain—highly specialized and costly blockchain engineers. This isn't a one-time project; it's a permanent team dedicated to building and, more importantly, maintaining the system.

- Constant Upgrades: The DeFi space evolves at a dizzying pace. Aave V3 requires different handling than Aave V2 (and Aave V4 is right around the corner). Morpho launched last year and introduced new models. New chains gain traction. Your team will be in a constant state of reactive maintenance just to keep the service from breaking, pulling them away from innovating on your actual product.

- Running Complex Infrastructure: You’ll need to run, manage, and maintain multiple RPC providers or full nodes for every blockchain you support to get reliable, real-time data. This is a significant infrastructure cost and reliability challenge in itself.

2. The Nightmare of Data Standardization

This is the challenge that trips up even the most sophisticated teams. Raw on-chain data is a chaotic mess of different formats and calculations.

- Incomparable Metrics: How do you accurately compare the APY from a lending protocol on Ethereum with a liquidity pool on Arbitrum that has token rewards? One protocol's aToken accrues interest differently than another's cToken.

- Building a Financial Engine: To provide a simple, comparable APY to your users, you need to build a complex financial calculation engine from scratch. This is a massive data science and financial engineering project that has nothing to do with your core business.

3. The Unseen Cost: Slow Time-to-Market

While your team spends the next 3-6 months building a fragile, single-protocol integration, your competitors will have already gone to market. The opportunity cost of being slow is immense in the fast-moving world of fintech.

The Solution: Focus on Your Strengths, We’ll Handle the Rest

Instead of trying to become experts in the arcane complexities of multi-chain DeFi data, you can leverage a single, powerful API to achieve a better result in a fraction of the time.

This is where vaults.fyi comes in. We handle the entire DeFi infrastructure layer for you.

- Discover Yield Opportunities: We do the hard work of ingesting, decoding, and standardizing data from over 50 protocols across more than 10 blockchains. With one simple API call, you can display clear, accurate, and comparable yield opportunities directly in your UI.

- Get Accurate Market Data & Portfolio Tracking: Gain access to comprehensive, real-time market data and enable your users to easily track their DeFi portfolios directly within your application.

- Seamlessly Deposit and Withdraw Funds: We provide the transactional plumbing to allow your users to non-custodially deposit and withdraw funds from these vaults, all without ever leaving your application.

Choosing to partner with vaults.fyi is a strategic decision to:

- Accelerate Your Roadmap: Launch a comprehensive DeFi yield feature in weeks, not years.

- Slash Your Costs: Replace the massive cost of a dedicated engineering team, infrastructure, and audits with a predictable, transparent fee.

- Future-Proof Your Product: As we add new chains and protocols, they become instantly available to you through our API, with no additional engineering work required on your end.

Your business excels at building incredible user experiences and acquiring customers. Our business excels at managing the complexity of DeFi. Let's focus on what we do best.

Ready to see how simple embedding DeFi can be?

Explore our docs or get in touch with our team today.