vaults.fyi Onchain Yield Roundup - November 22, 2024

A look at the top DeFi opportunities:

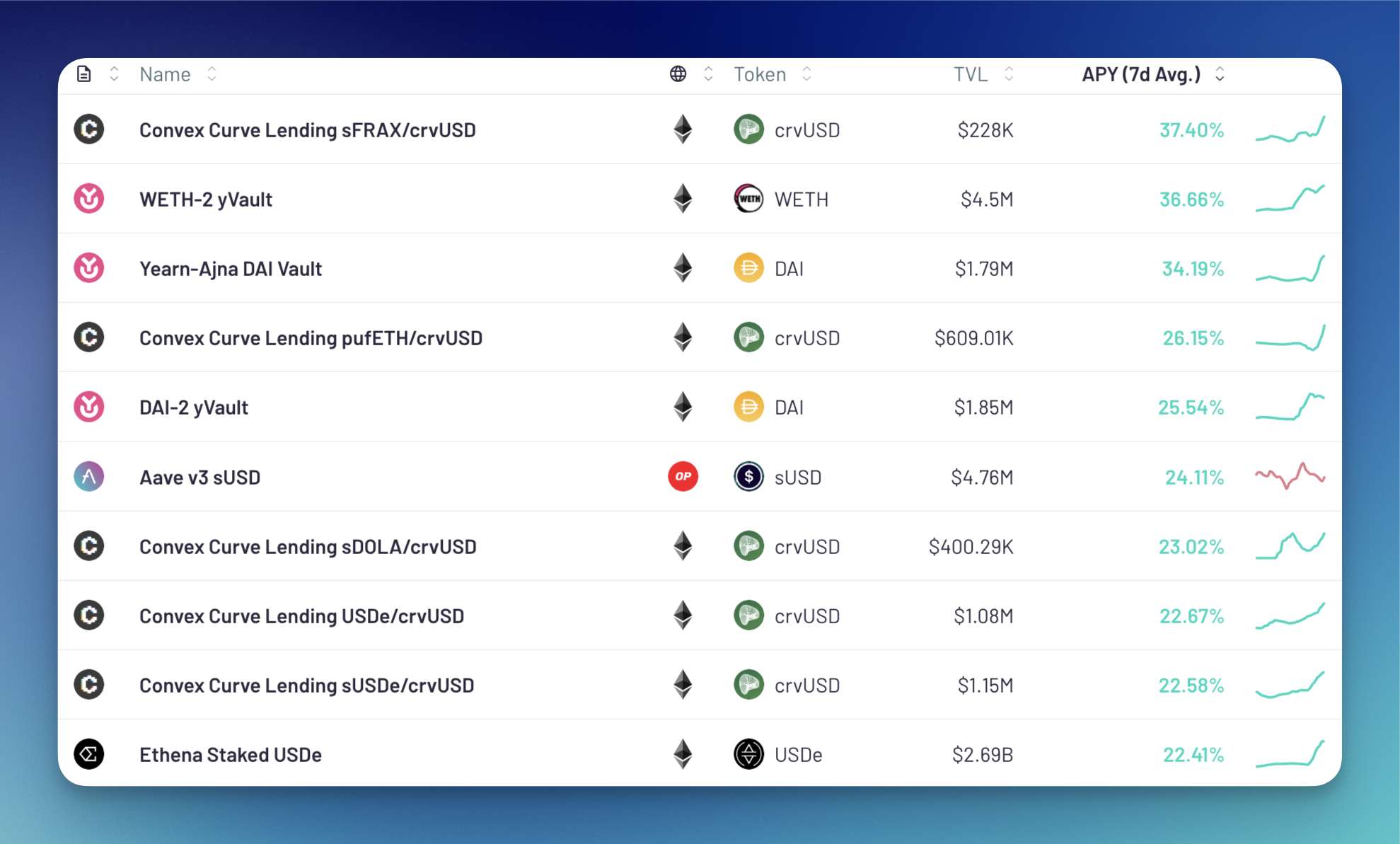

The top 3 yields on vaults.fyi are above 30%. Convex’s sFRAX/crvUSD vault leads with 37.40% APY, while Yearn’s WETH-2 yVault and Yearn x Ajna’s DAI Vault follow with 36.66% and 34.19% APY, respectively. Currently, 5/10 of the top APYs on vaults.fyi are crvUSD yields from Convex Finance.

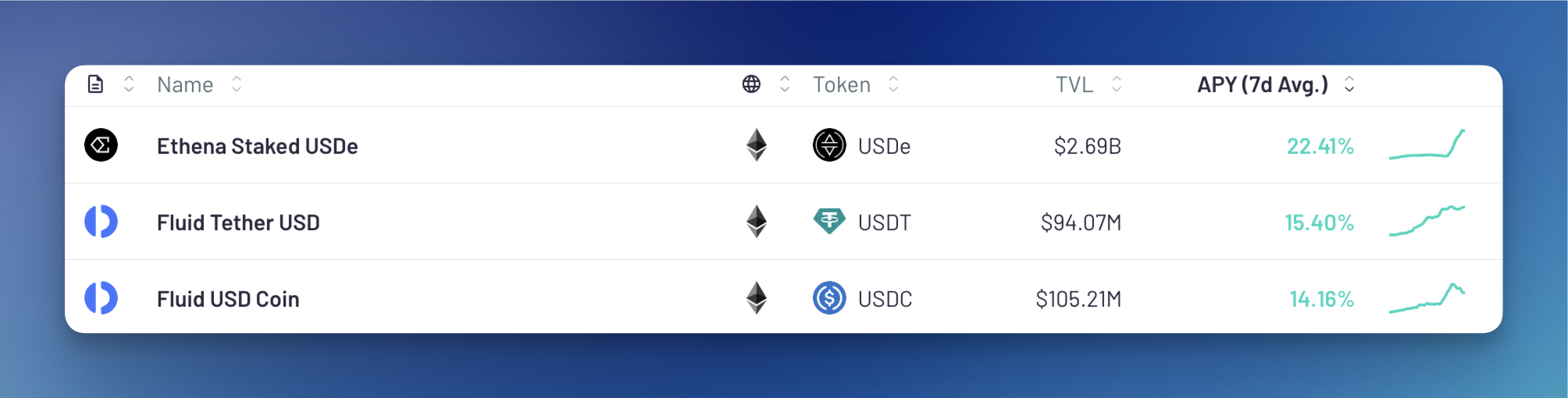

Ethena’s USDe leads in the >$50M TVL category with 22.41% APY, an impressive yield given its $2.68B TVL. Fluid’s USDT and USDC mainnet vaults also continue their recent performance with APYs near 15%.

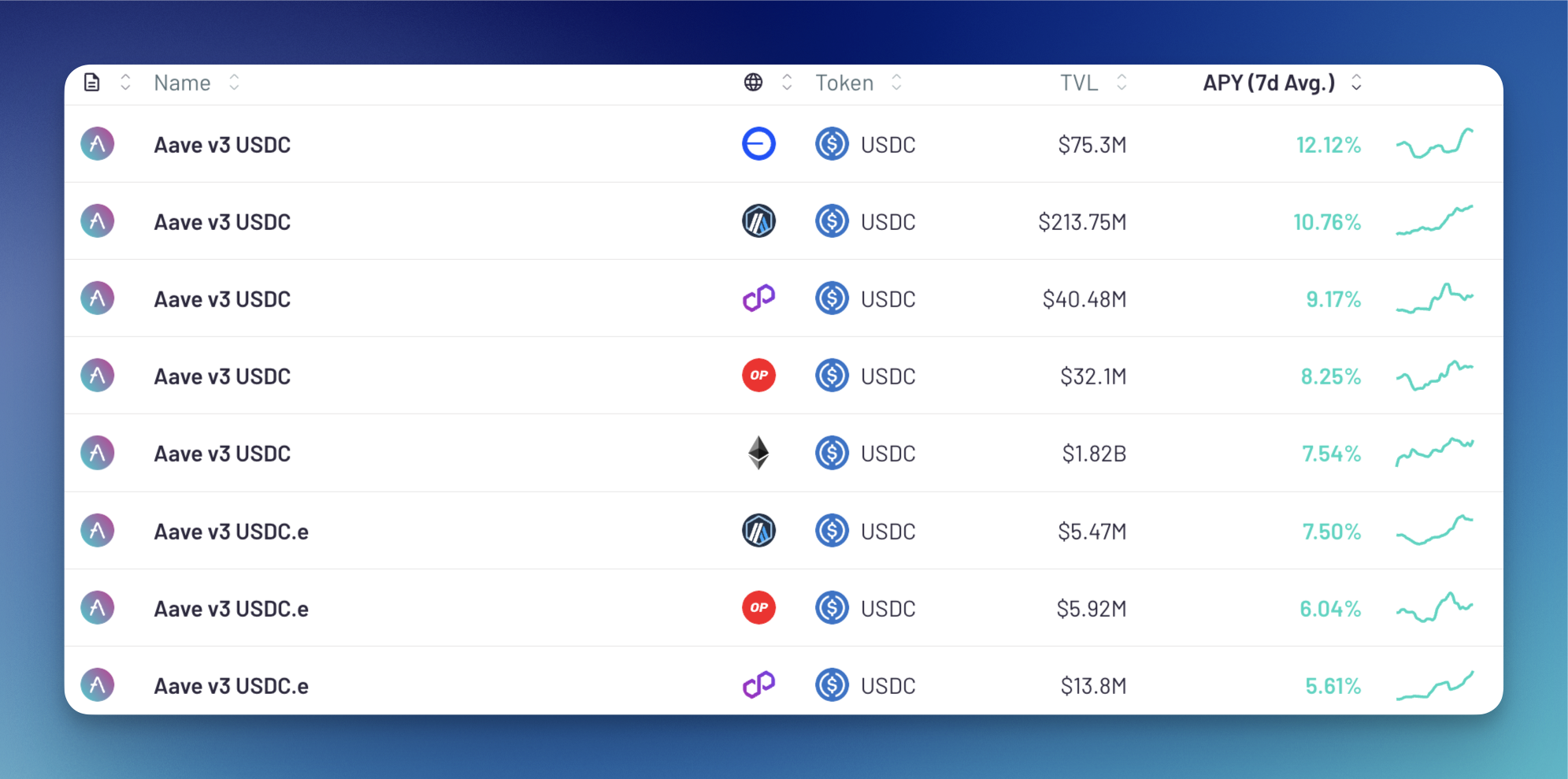

Coinbase announces a passive 4.7% yield for users holding USDC on Coinbase Wallet. Aave v3 USDC rates show that lending protocols offer superior yields, yet the 4.7% baseline may push up DeFi rates across the board and make the space more competitive.

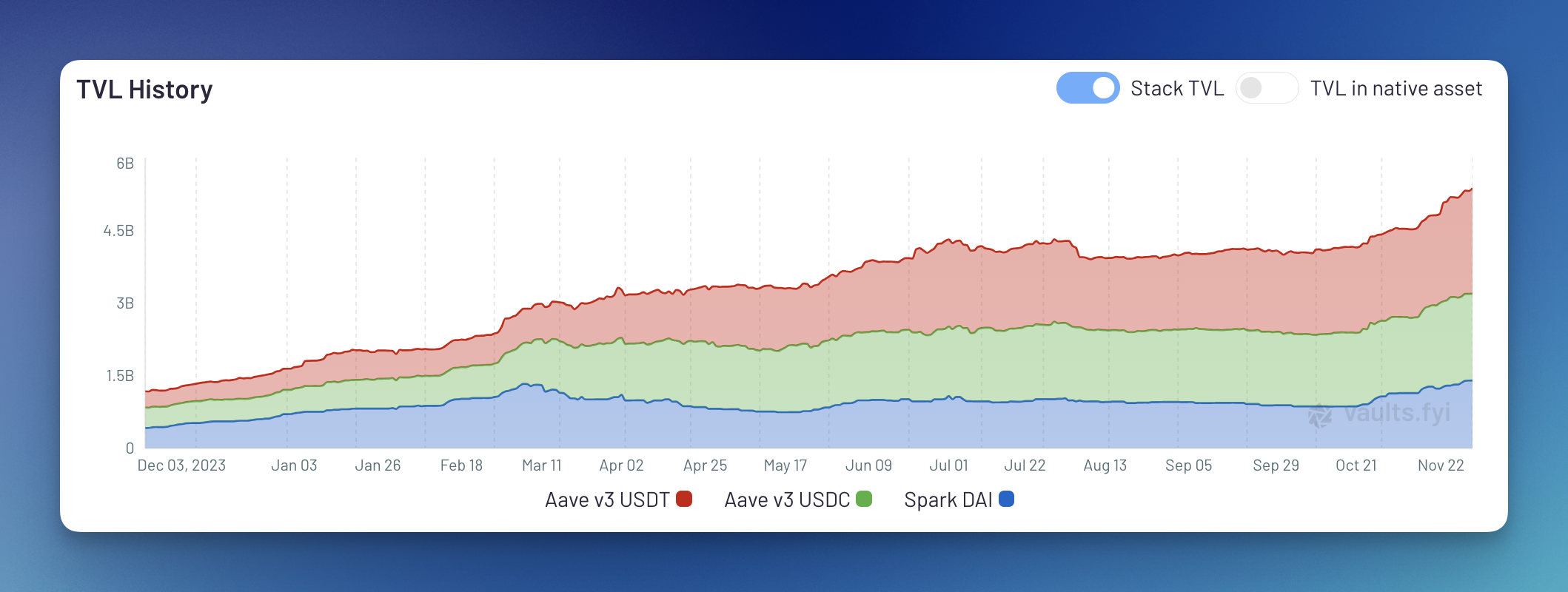

TVL in major lending protocols continues to rise, suggesting that traders seek additional leverage as the crypto market grinds upward. Spark’s DAI vault reached $1.4B TVL, while Aave’s mainnet USDT and USDC vaults sit at $2.22B and $1.82B TVL, respectively. This comes as Marc Zeller reports that Aave's revenue, TVL, and borrows are currently at an all-time high.