vaults.fyi Onchain Yield Roundup - November 15, 2024

A look at the top DeFi opportunities:

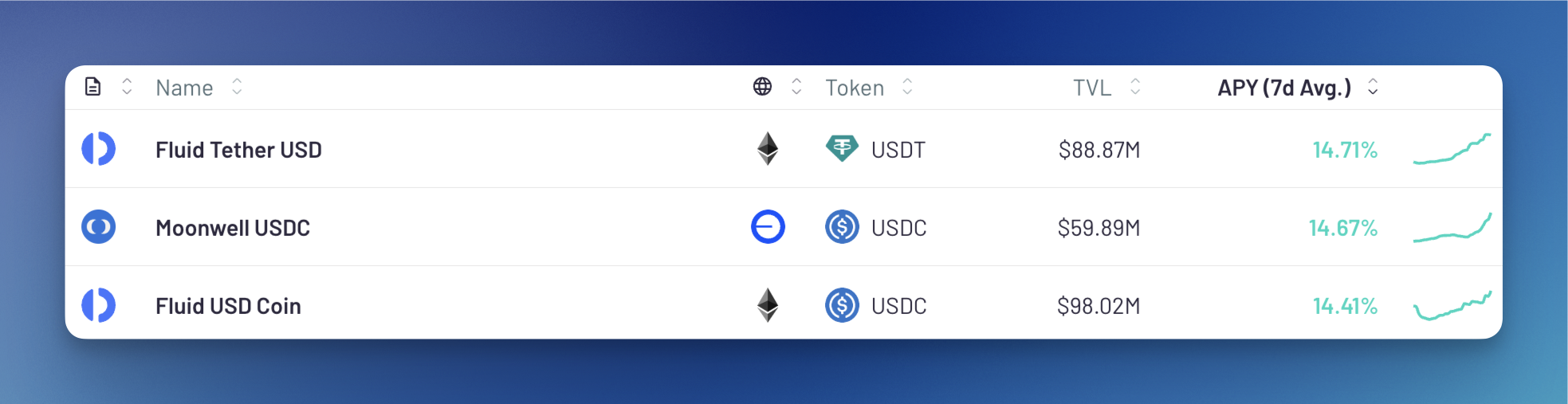

Following the US election, DeFi yields have seen significant boosts across the board. Borrower demand has skyrocketed amid bullish sentiment, sending lending rates higher. Notably, Fluid achieved 100% utilization rates in their USDC and USDT mainnet vaults, resulting in ~14% APY (7d avg). Moonwell’s USDC vault on base saw a similar APY in the >$50M TVL category.

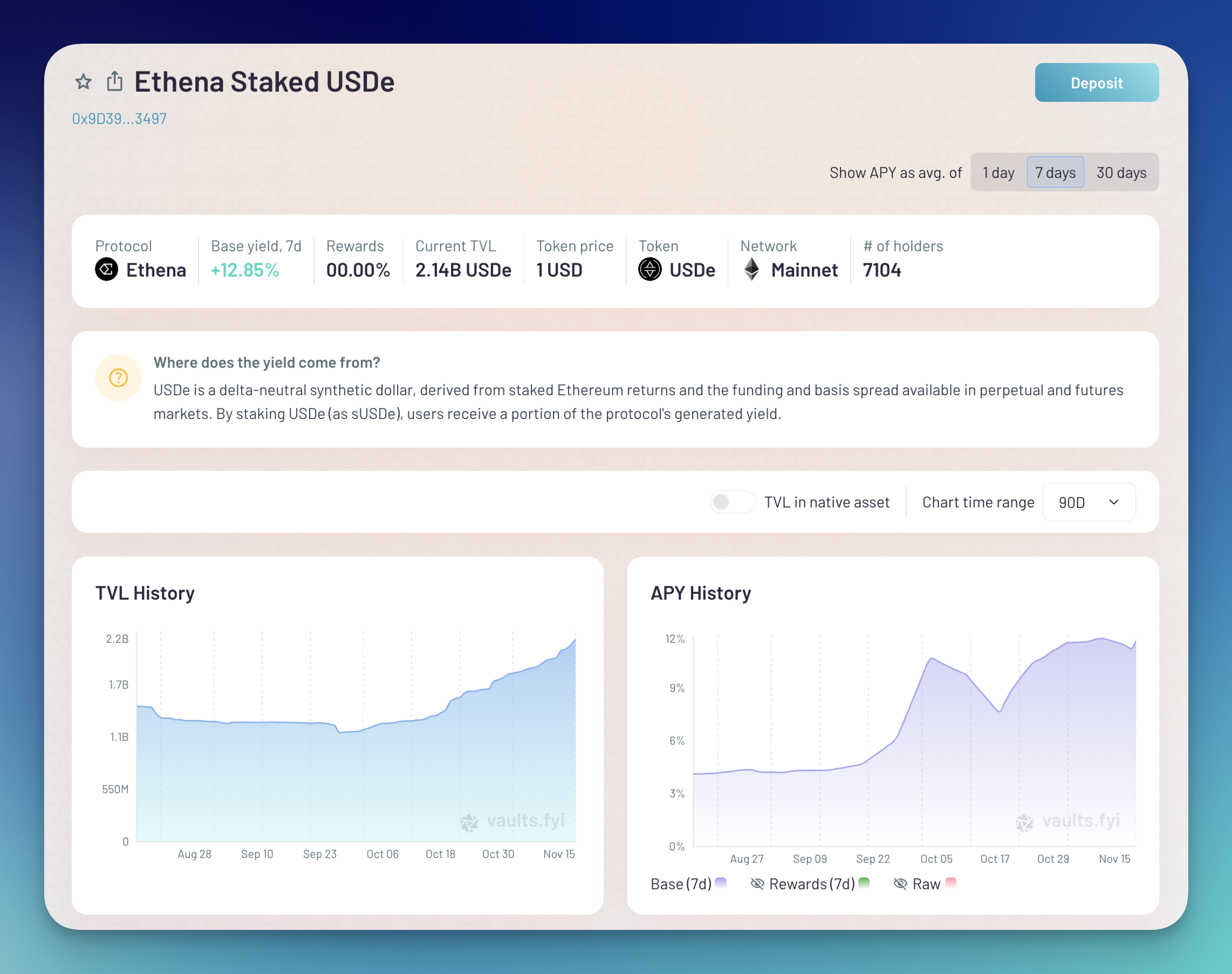

TVL in Ethena’s USDe has risen by ~800M over the last month. APY is currently 12.85%, making it the only vault on vaults.fyi with a double-digit yield with TVL >$1B. The recent inflows suggest an increasing appetite for “risk-on” DeFi yields.

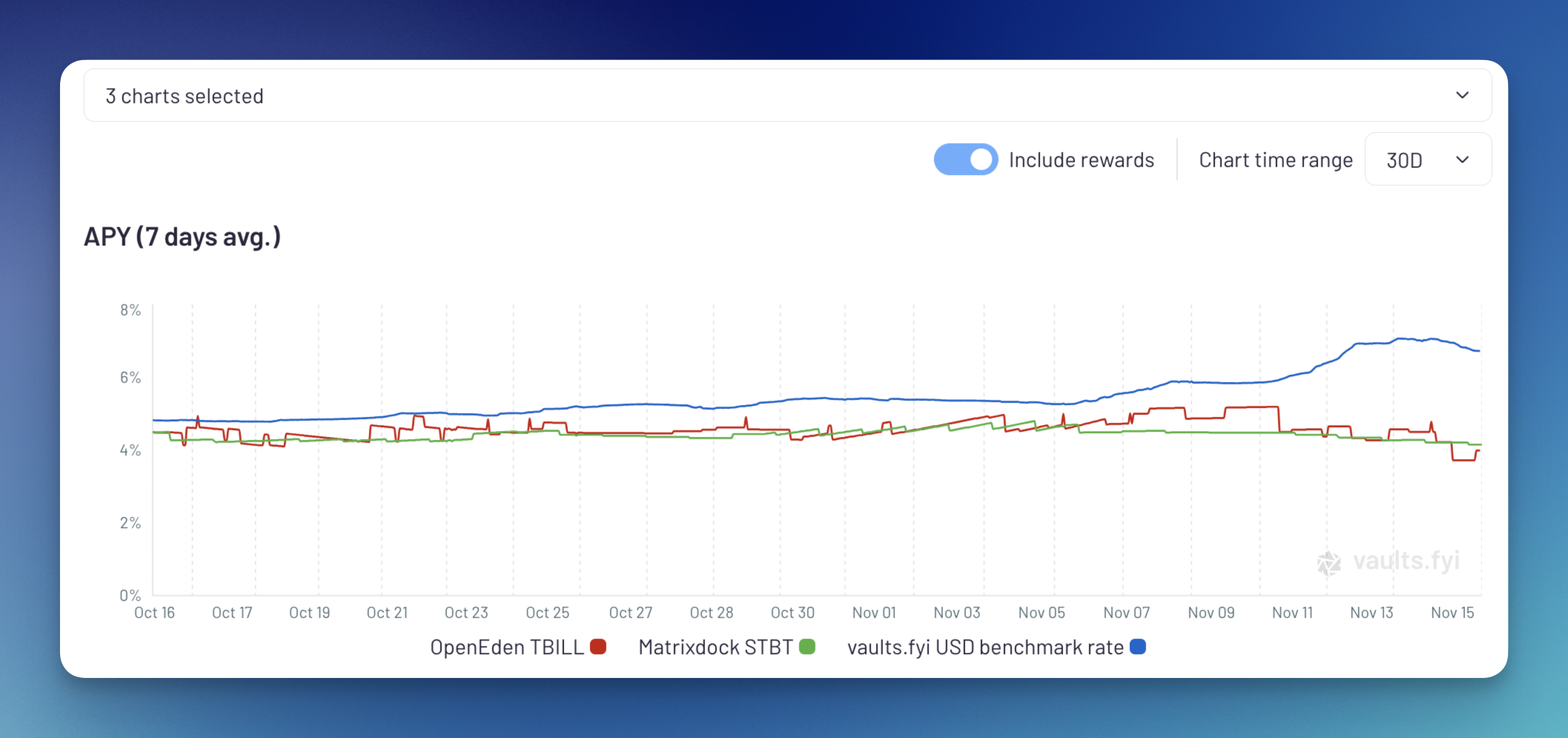

Our USD benchmark rate, a weighted average of Aave v3 USDC, Aave v3 USDT, sDAI, and Compound v3 USDC, now sits at ~7%. This puts “blue-chip” DeFi yields at a considerable premium over the going US T-Bill rate (currently 4.58%). vaults.fyi’s Chart Explorer highlights this widening gap compared to onchain T-Bill products.

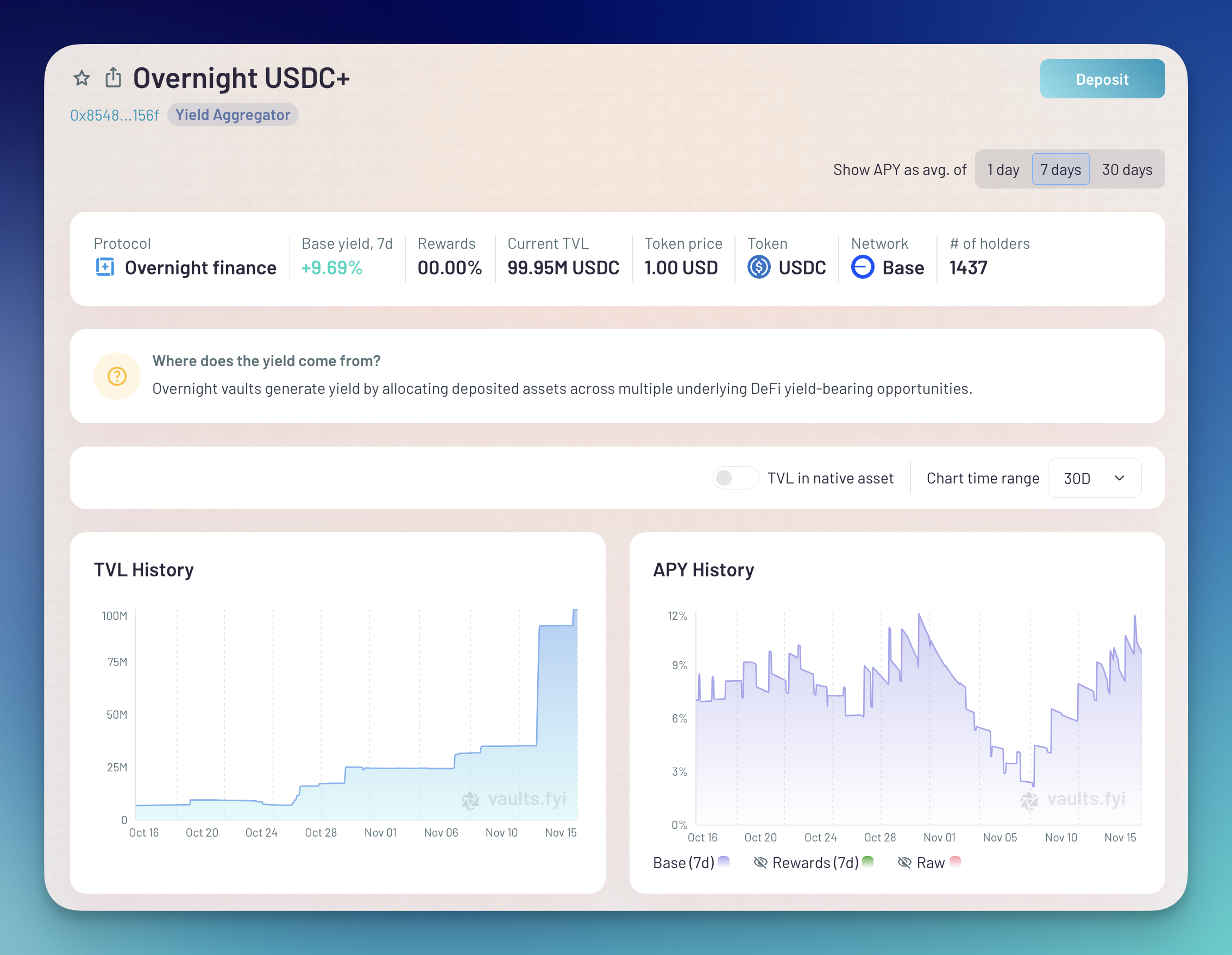

Overnight Finance’s USDC+ vault on base saw considerable inflows, growing from ~$6M to ~$100M TVL over the last month. APY is currently 9.69%. This coincides with base recently reaching the milestone of $10B in total TVL, suggesting that onchain capital continues to favor the L2.