vaults.fyi Onchain Yield Roundup - December 12, 2024

A look at the top DeFi opportunities:

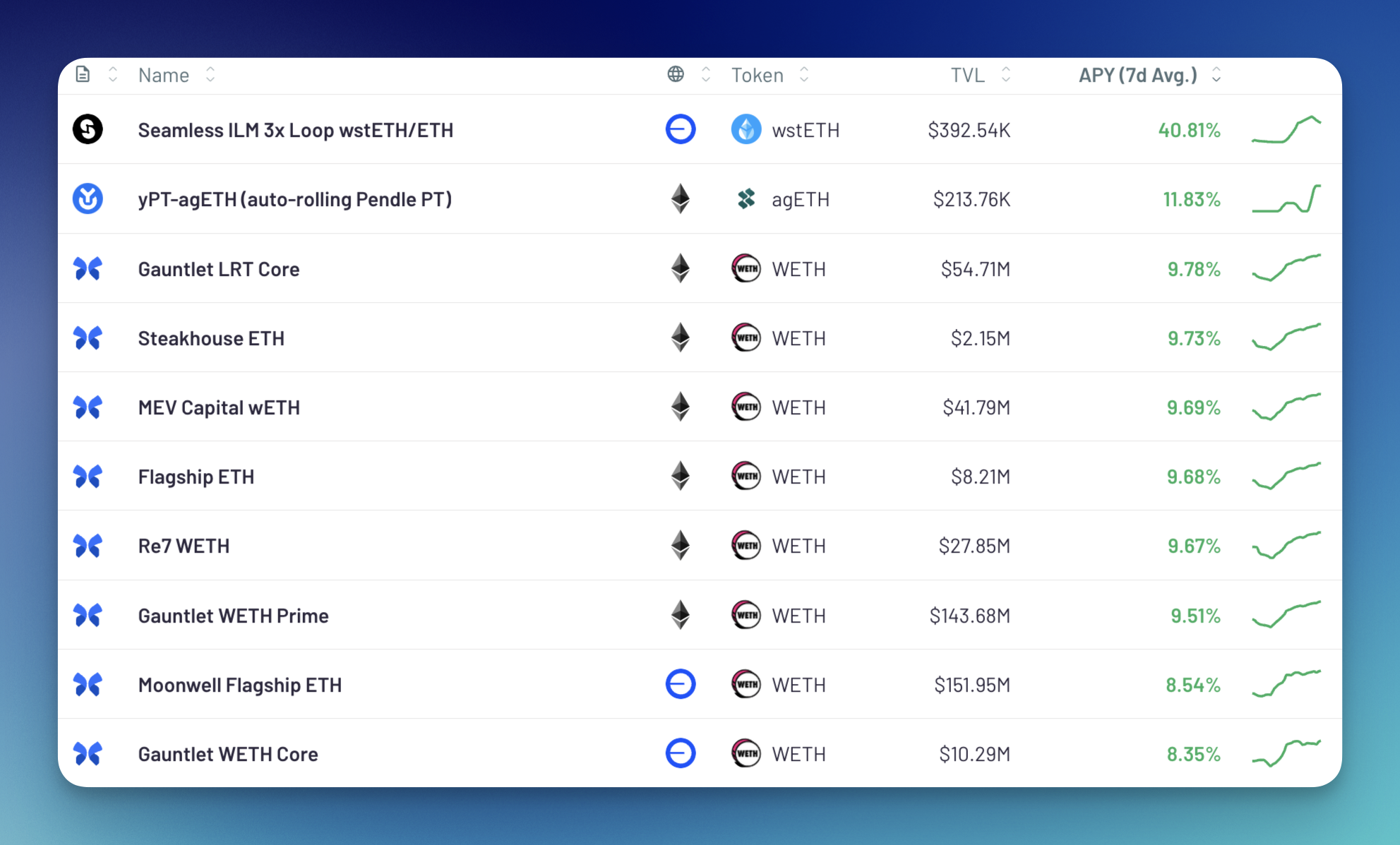

ETH yields are up following recent positive sentiment and price action. Seamless Finance’s ILM 3x Loop wstETH/ETH vault provides the top APY at 40.81%, followed by Yearn’s yPT-agETH at 11.83%. The remainder of the top 10 are Morpho vaults from various risk curators on mainnet and base.

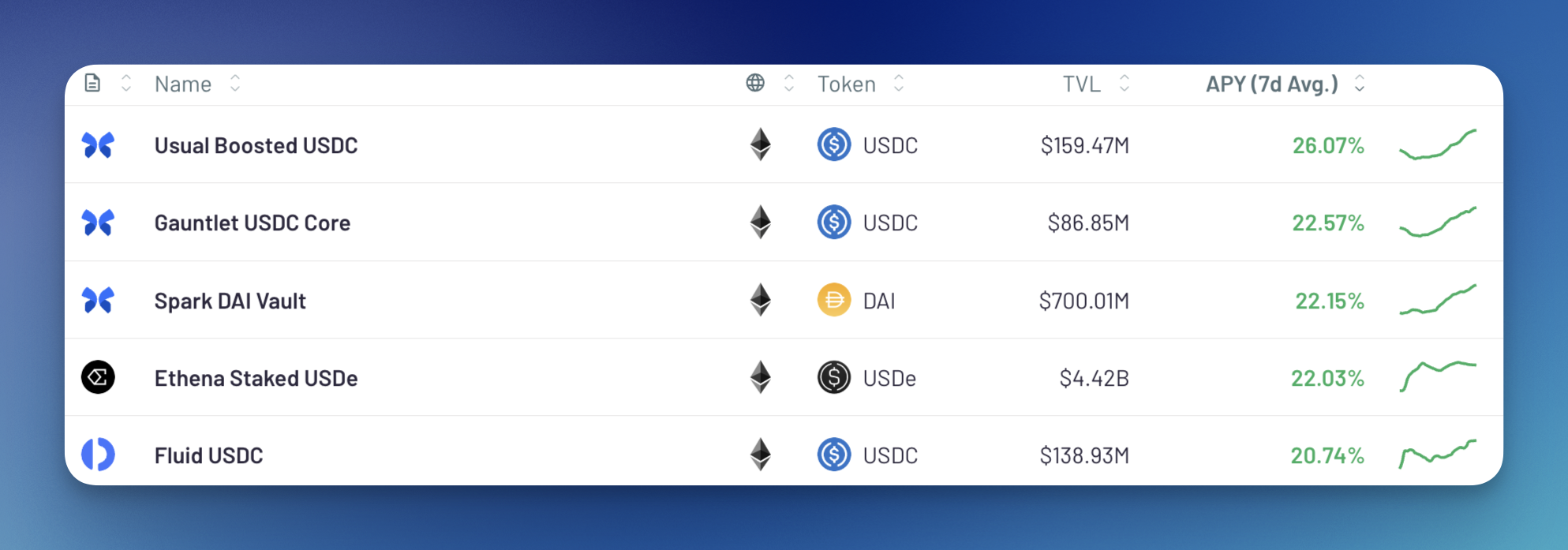

In the $50M+ TVL category on vaults.fyi, the top 5 yields are above 20%. Morpho vaults continue their recent performance with 26.07%, 22.57%, and 22.15% APY. Ethena’s USDe and Fluid’s USDC follow with 22.03% and 20.74% APY. All vaults are USD yields on the Ethereum mainnet.

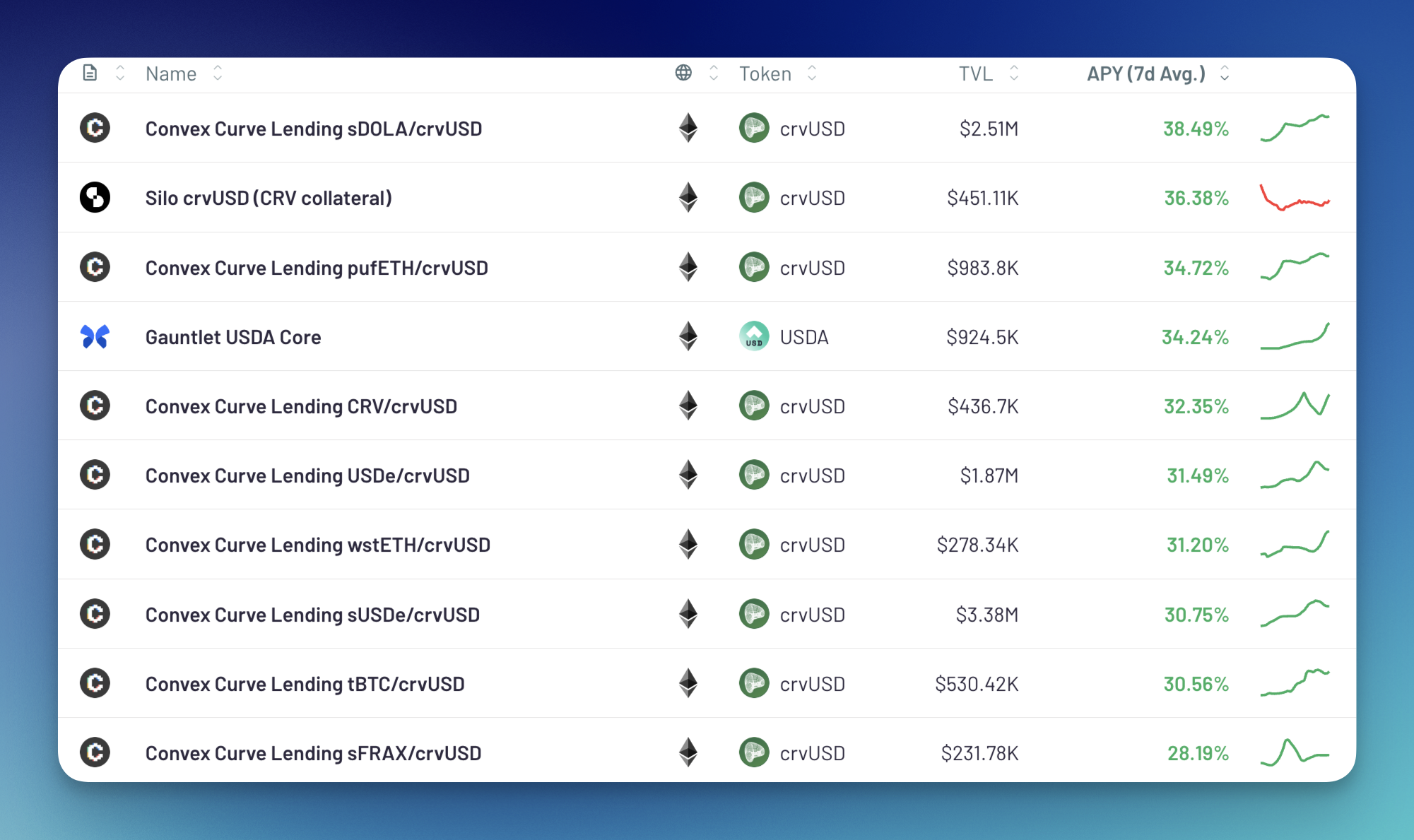

USD yields of any TVL are almost entirely dominated by Convex Finance’s crvUSD vaults, offering APYs ranging from 28 - 38%. Gauntlet’s USDA Core is the only non-crvUSD vault featured, with 34.24% APY.

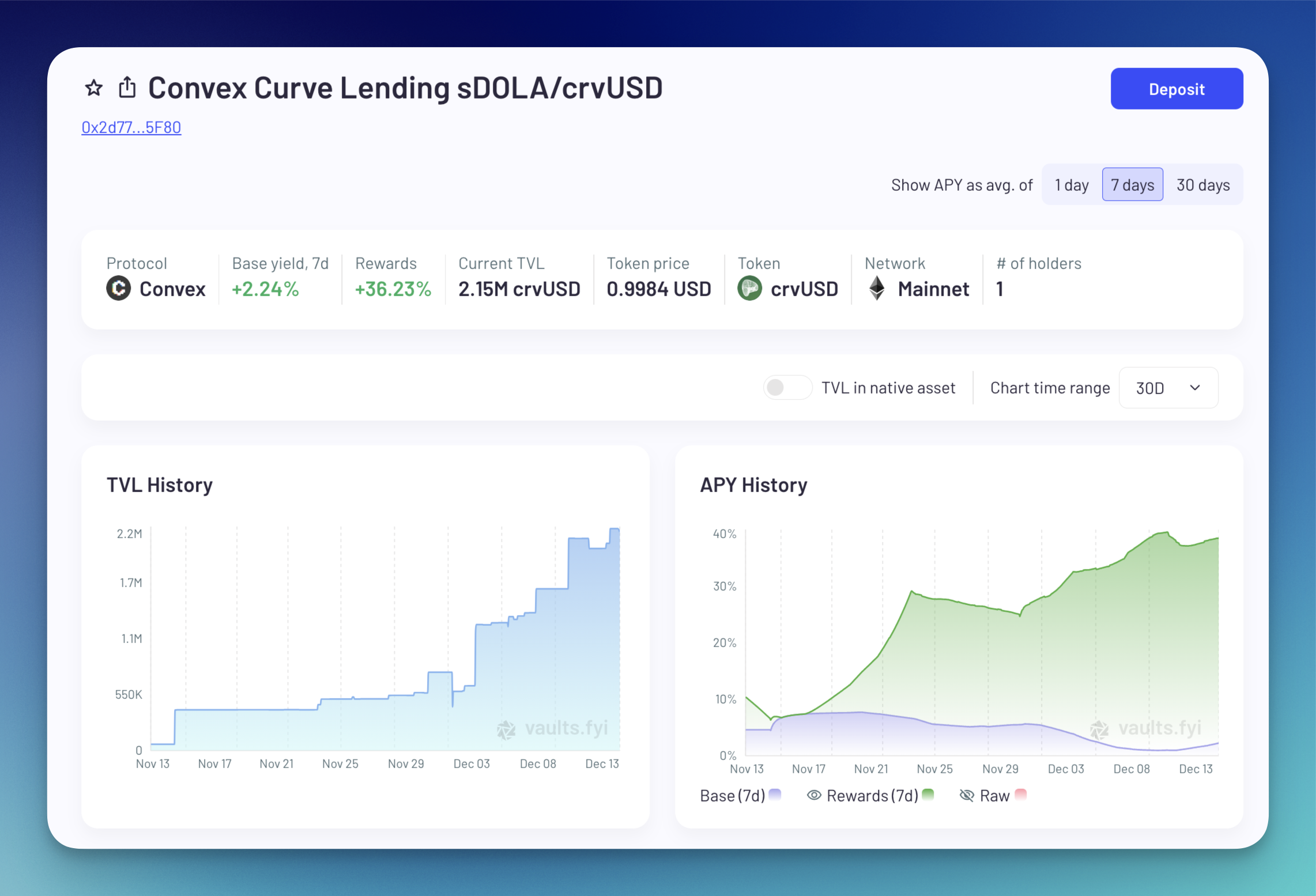

Convex Finance’s sDOLA/crvUSD vault is currently yielding 38.47% APY, with the majority coming from rewards. The vault accepts crvUSD deposits with Inverse Finance’s sDOLA as collateral. TVL began to flow into the vault after the US election and is currently at ATH ($2.15M). It now has the highest APY of any USD vault tracked on vaults.fyi.