vaults.fyi Onchain Yield Roundup - January 10, 2025

A look at the top DeFi opportunities:

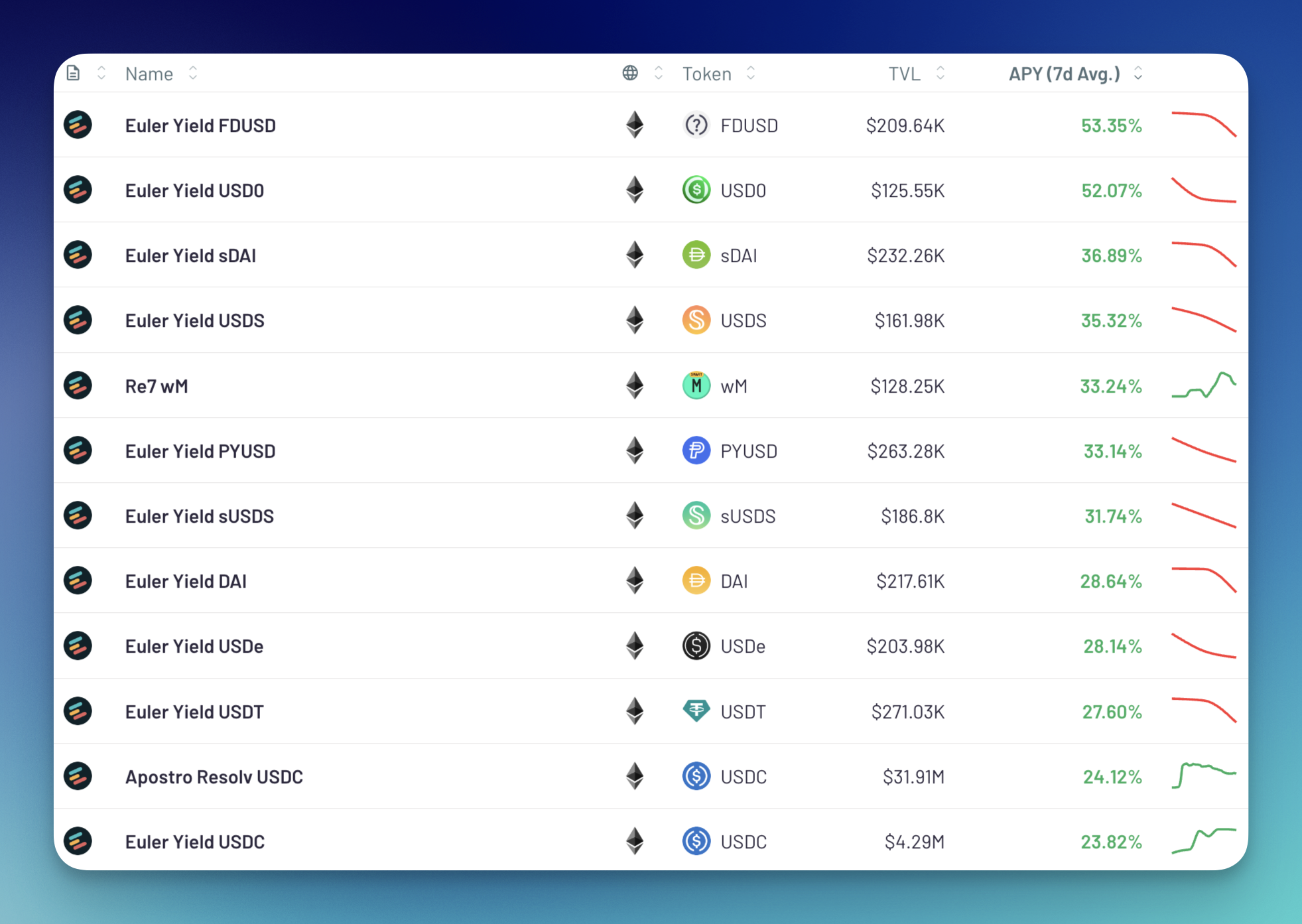

Euler Finance sweeps the yield rankings this week, with their recently introduced 'Euler Yield' vaults claiming multiple top spots. APYs range from 23% to 53%, with their FDUSD vault leading with 53.35% APY 👇

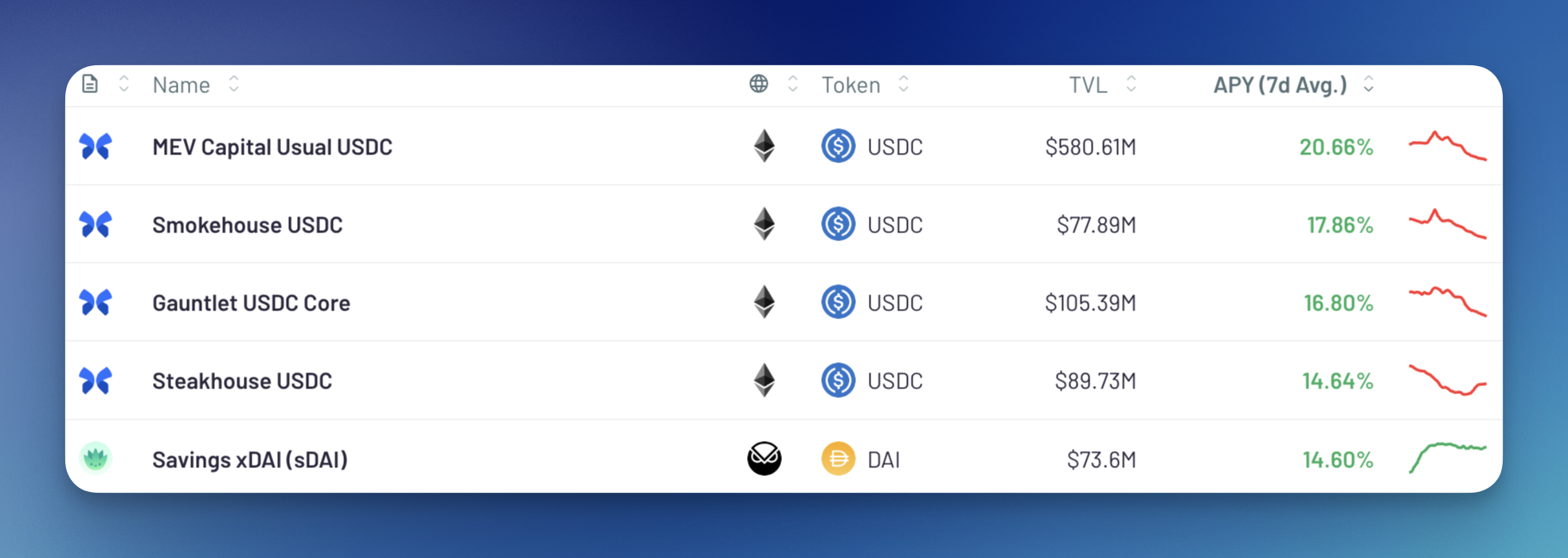

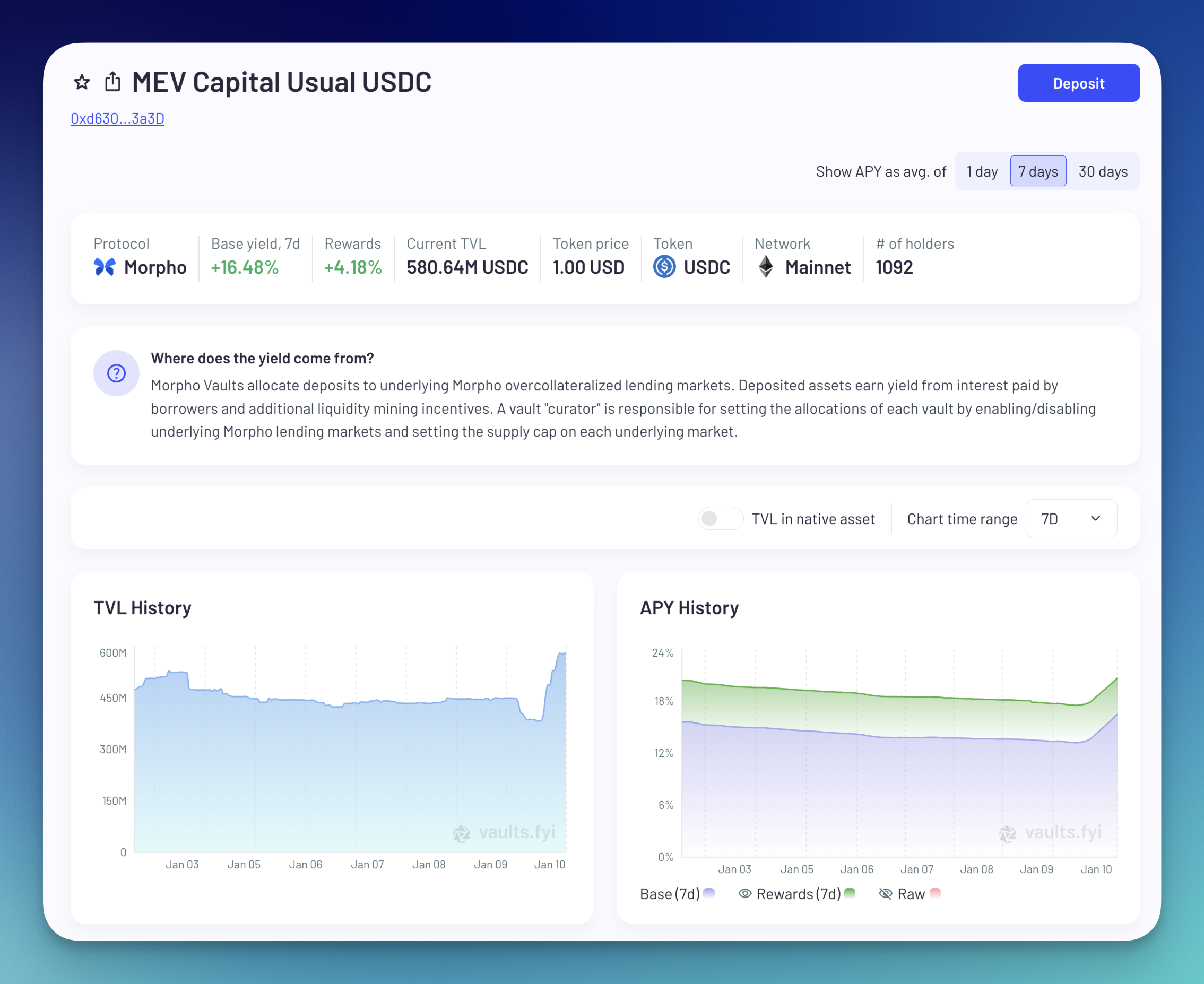

Morpho vaults again dominate the >$50M TVL category, with MEV Capital Usual USDC currently offering the highest APY – despite concerns explored below. The protocol has seen impressive performance in this category with its USDC vaults consistently performing well. The top yield after Morpho is Savings DAI on Gnosis Chain with 14.60% APY.

However, MEV Capital Usual USDC’s high yield is directly related to recent concerns around USD0++, which serves as collateral for the vault. As lenders have withdrawn liquidity due to USD0++'s depegging, utilization rates have increased, temporarily driving up yields. As always, exercise caution before entering positions!

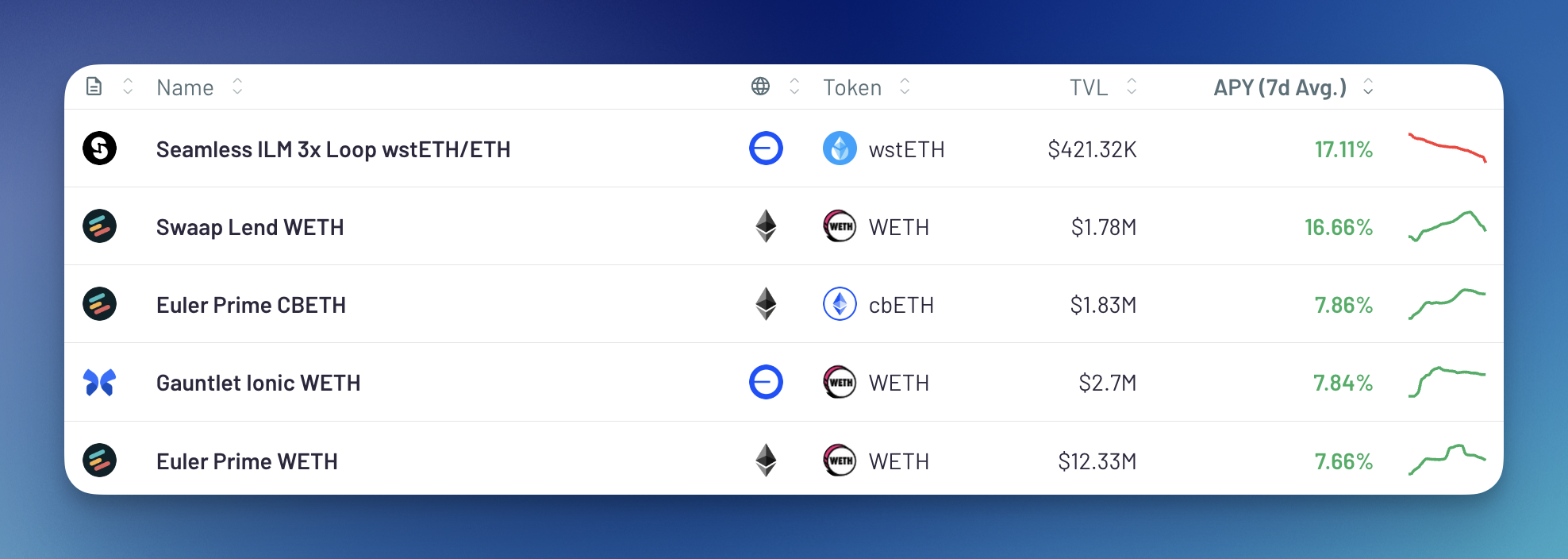

The highest ETH yields on vaults.fyi comes from Seamless Finance’s leveraged wstETH/ETH vault at 17.11% APY, followed closely by Swaap Finance's WETH vault at 16.66%. Euler Finance rounds out the top 5 with their Prime cbETH and WETH vaults, alongside Gauntlet’s Ionic vault, all offering ~7.8% APY 👇