vaults.fyi Onchain Yield Roundup - January 3, 2025

A look at the top DeFi opportunities:

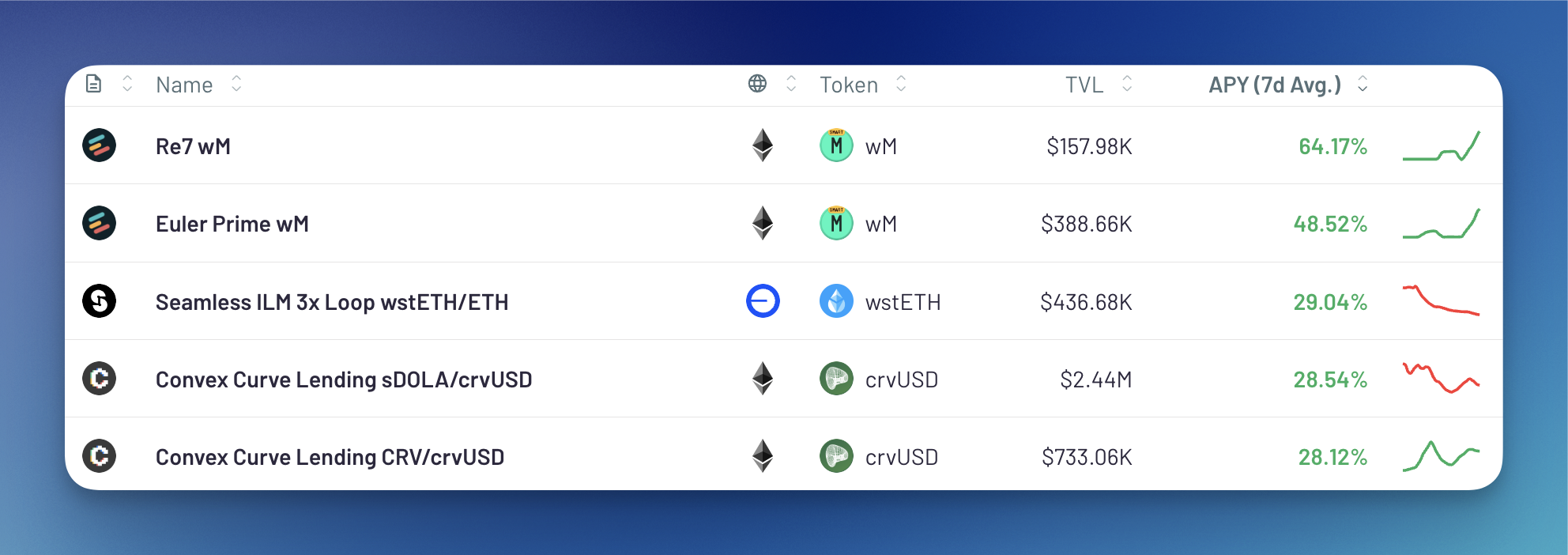

Two vaults from Euler Finance featuring the M token from M^0 take the top spots on vaults.fyi with 64.17% and 48.52% APY. Vaults from Seamless and Convex Finance continue their recent performance with APYs of ~28%.

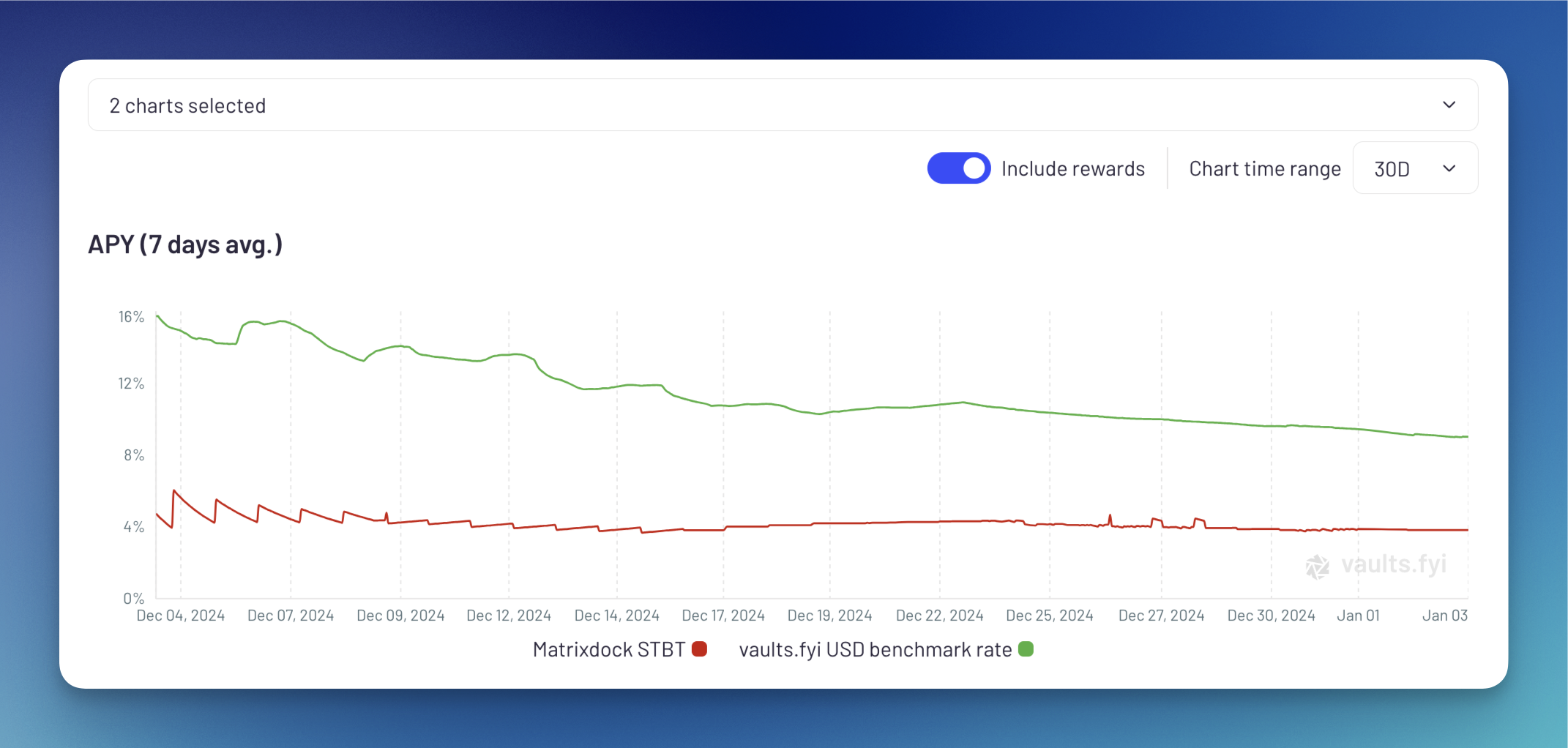

Blue-chip USD yields are down from highs of 16% earlier this month, yet remain comfortably above the going US T-Bill rate. vaults.fyi’s USD benchmark rate is a weighted average of Aave v3 USDC, Aave v3 USDT, and Savings DAI. The metric is compared to Matrixdock’s onchain T-Bill product below to showcase the gap between blue-chip DeFi and TradFi yields.

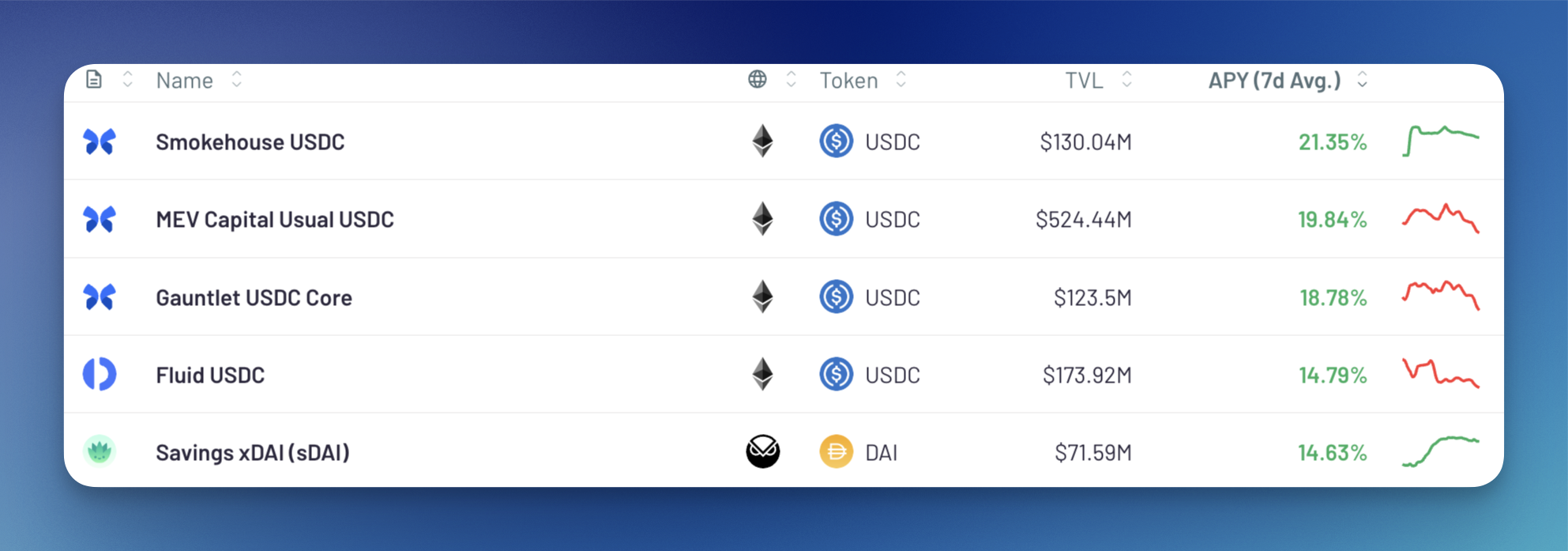

The top 3 yields in the >$50M TVL category are all Morpho USDC vaults. APYs range from ~18% to ~21%, including MORPHO token rewards. The recently renamed MEV Capital Usual USDC vault stands out with a significantly higher TVL than other vaults. Fluid USDC and Savings DAI on Gnosis Chain also offer yields near 15%.

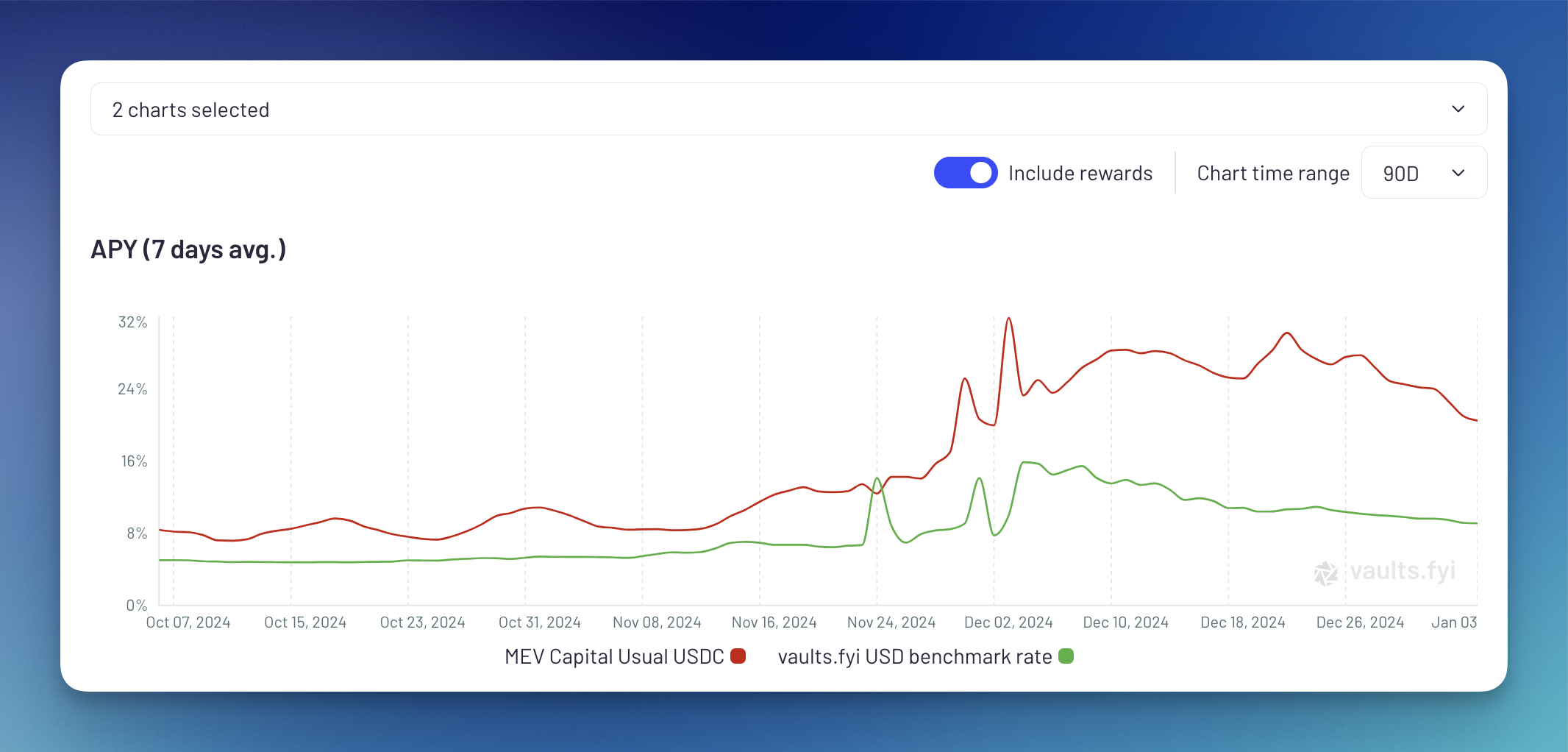

MEV Capital Usual USDC, previously named Usual Boosted USDC, has the highest APY with >$150M TVL on vaults.fyi. MEV Capital, the Morpho vault’s risk curator, recently renamed the vault and announced the integration of additional markets and rebalancing of performance fees. The vault has consistently outperformed vaults.fyi’s USD benchmark rate in recent months.