vaults.fyi Onchain Yield Roundup November 1, 2024

A look at the top DeFi opportunities:

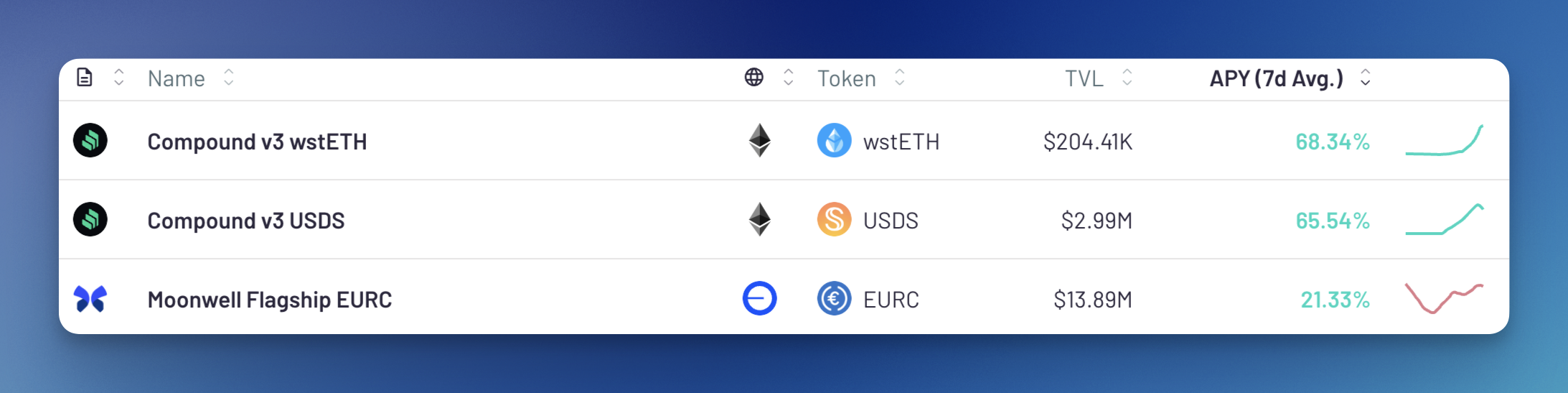

Compound v3 USDS and Compound v3 wstETH are on vaults.fyi! They are currently the 2 highest-yielding vaults across all that we track, with 65.54% and 68.34% APY, respectively, owing to substantial COMP rewards. The Moonwell Flagship EURC Morpho vault rounds out the top 3 with 21.33% APY.

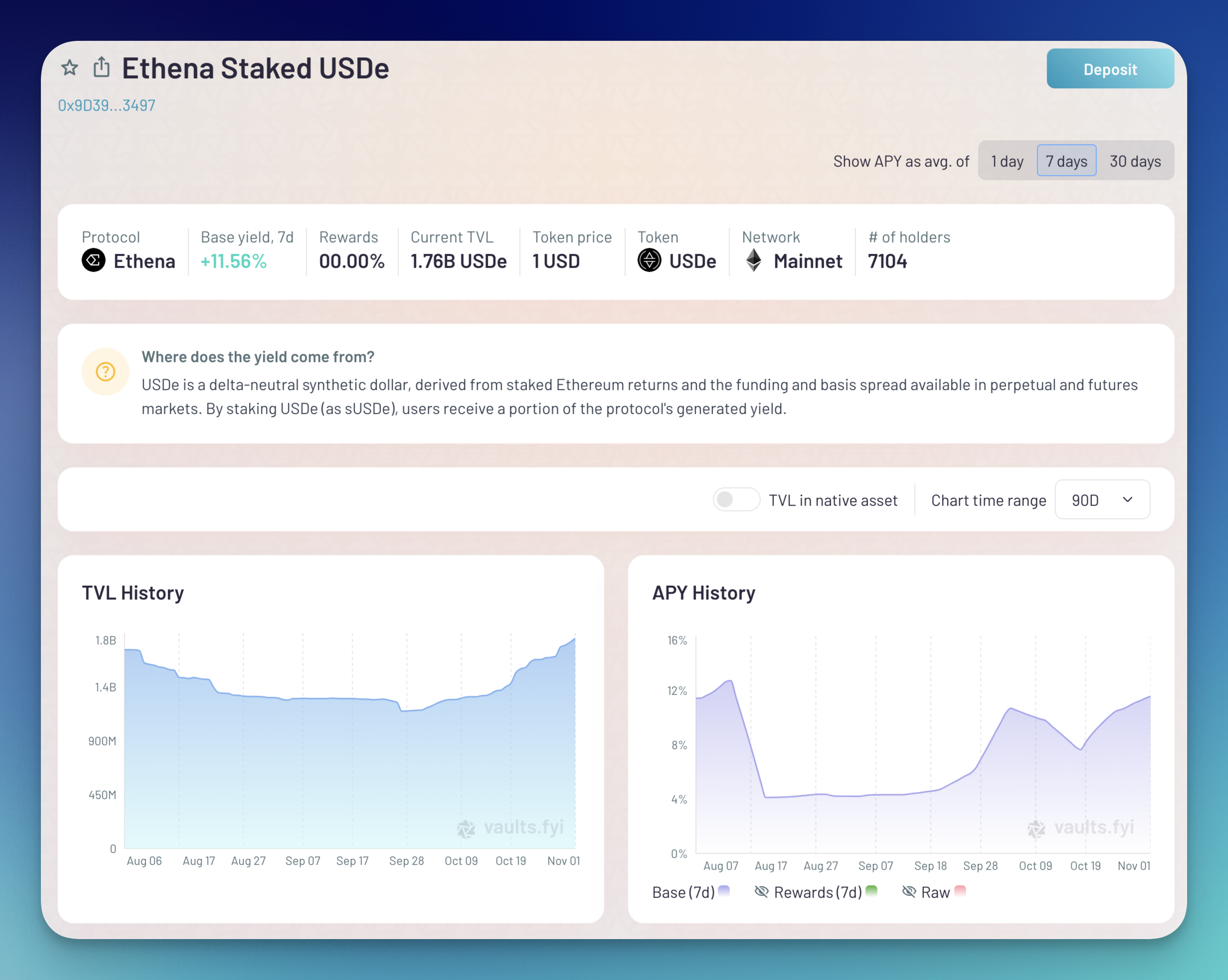

Ethena’s USDe grew by another ~$150M (10%) in TVL this week as positive funding rates sustain double-digit APY. It is now the highest-yielding vault >$50M TVL on vaults.fyi, with 11.56% APY. Next week will be crucial for risk-on yields like USDe as BTC tests ATHs heading into the US election.

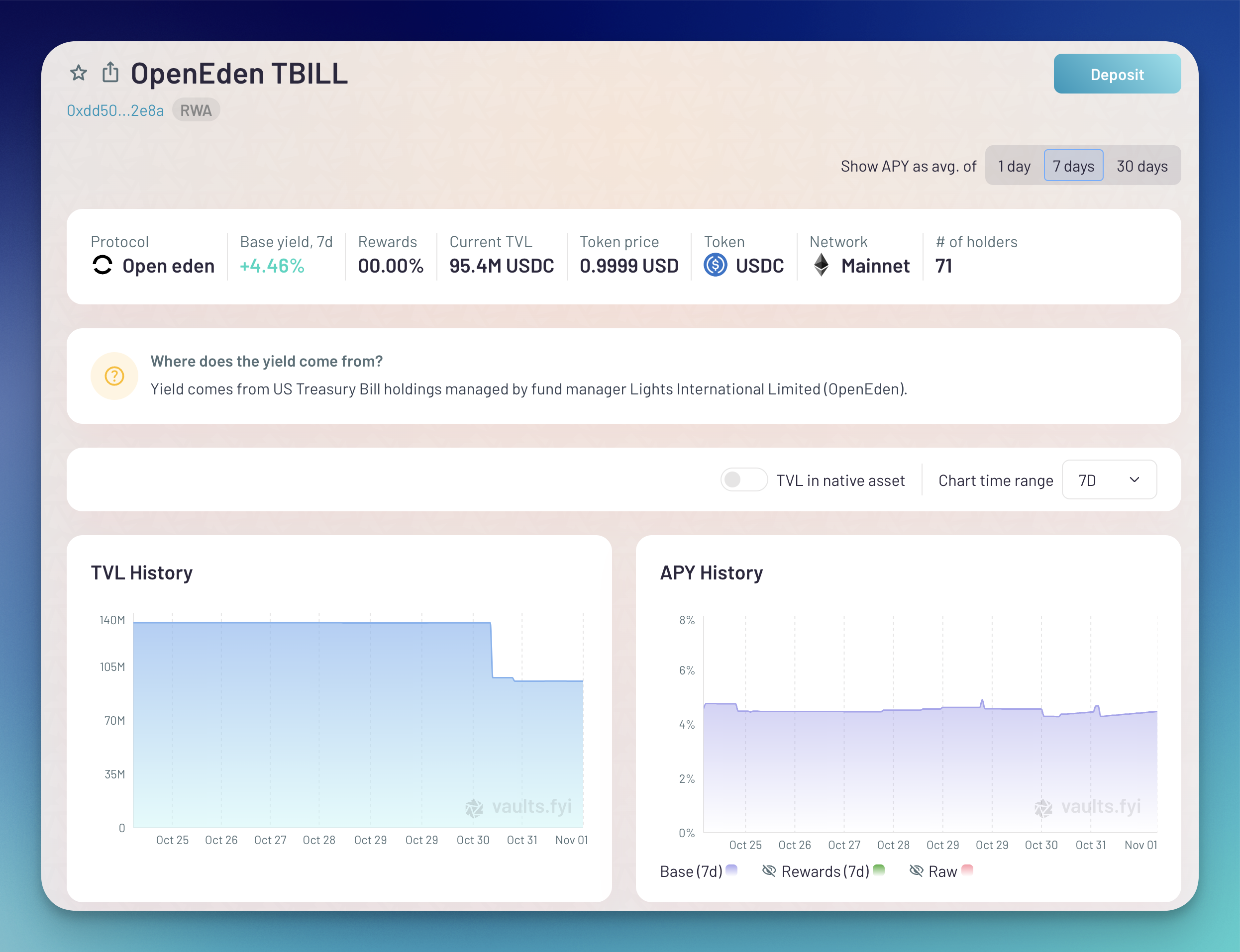

OpenEden’s tokenized T-BILL product saw considerable outflows following misconduct allegations against a founding partner. The incident highlights how public opinion remains a crucial driver of onchain adoption. OpenEden has since parted ways with the individual in question, yet the long-term impact on OpenEden and the RWA space in general remains to be seen.

DeFi’s yield premium is starting to widen once again. The vaults.fyi USD benchmark rate – weighted across the largest USDC, USDT, and DAI vaults – now outpaces US T-Bill yields. Our Chart Explorer shows this widening spread versus onchain T-Bill products.