vaults.fyi Onchain Yield Roundup - December 6, 2024

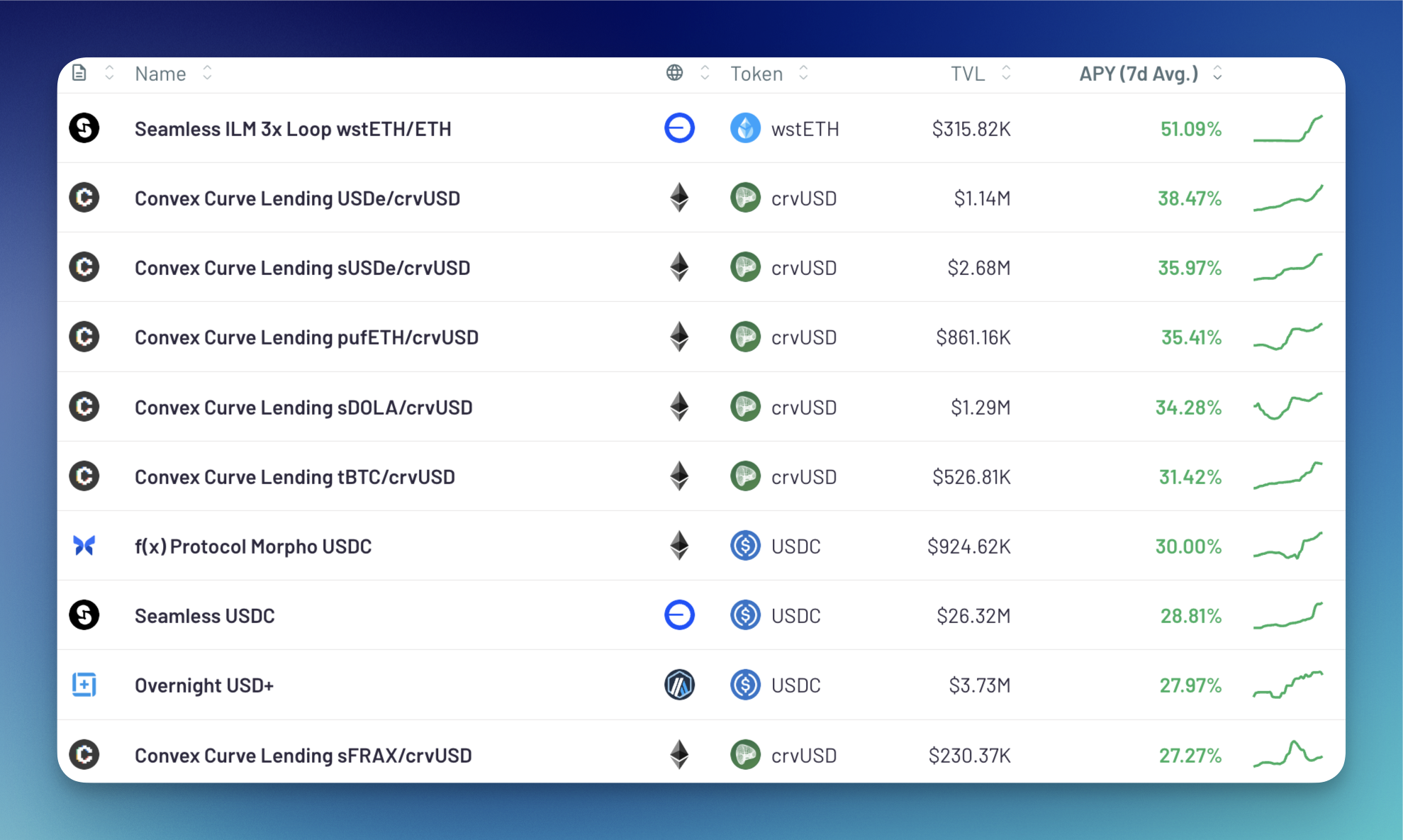

A look at the top DeFi opportunities:

Seamless Finance’s wstETH/ETH vault tops vaults.fyi with 51.09% APY, following recent positive ETH price action. Convex Finance dominates the remainder of the top 10 with APYs > 30% in multiple crvUSD vaults.

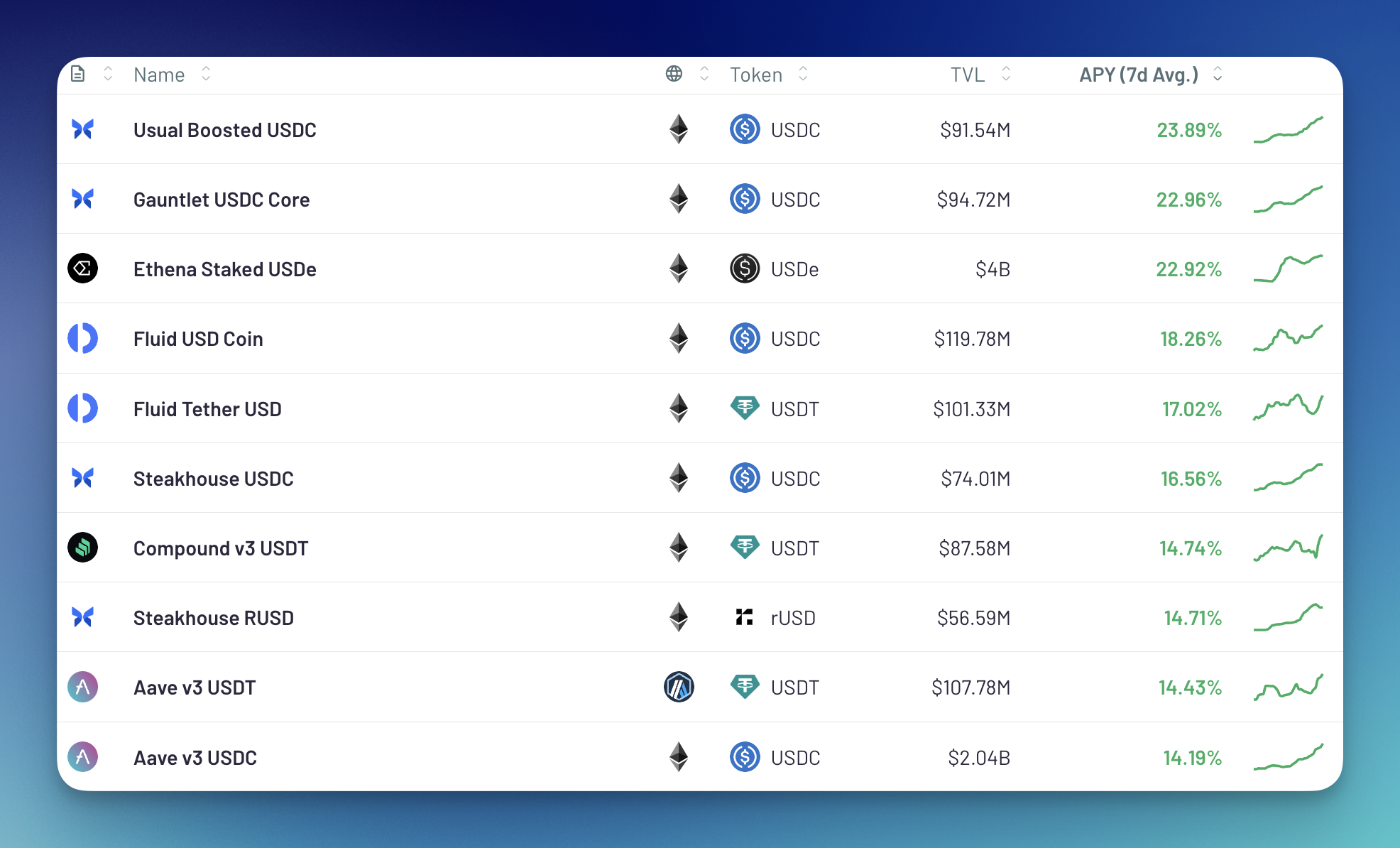

In the > $50M TVL category, two Morpho vaults have dethroned USDe with 23.89% and 22.96% APY respectively. This high yield is explained by positive price action for the MORPHO token, which accounts for ~7% of APY in each vault—the rest of the top 10 features stablecoin vaults from Fluid, Compound, and Aave.

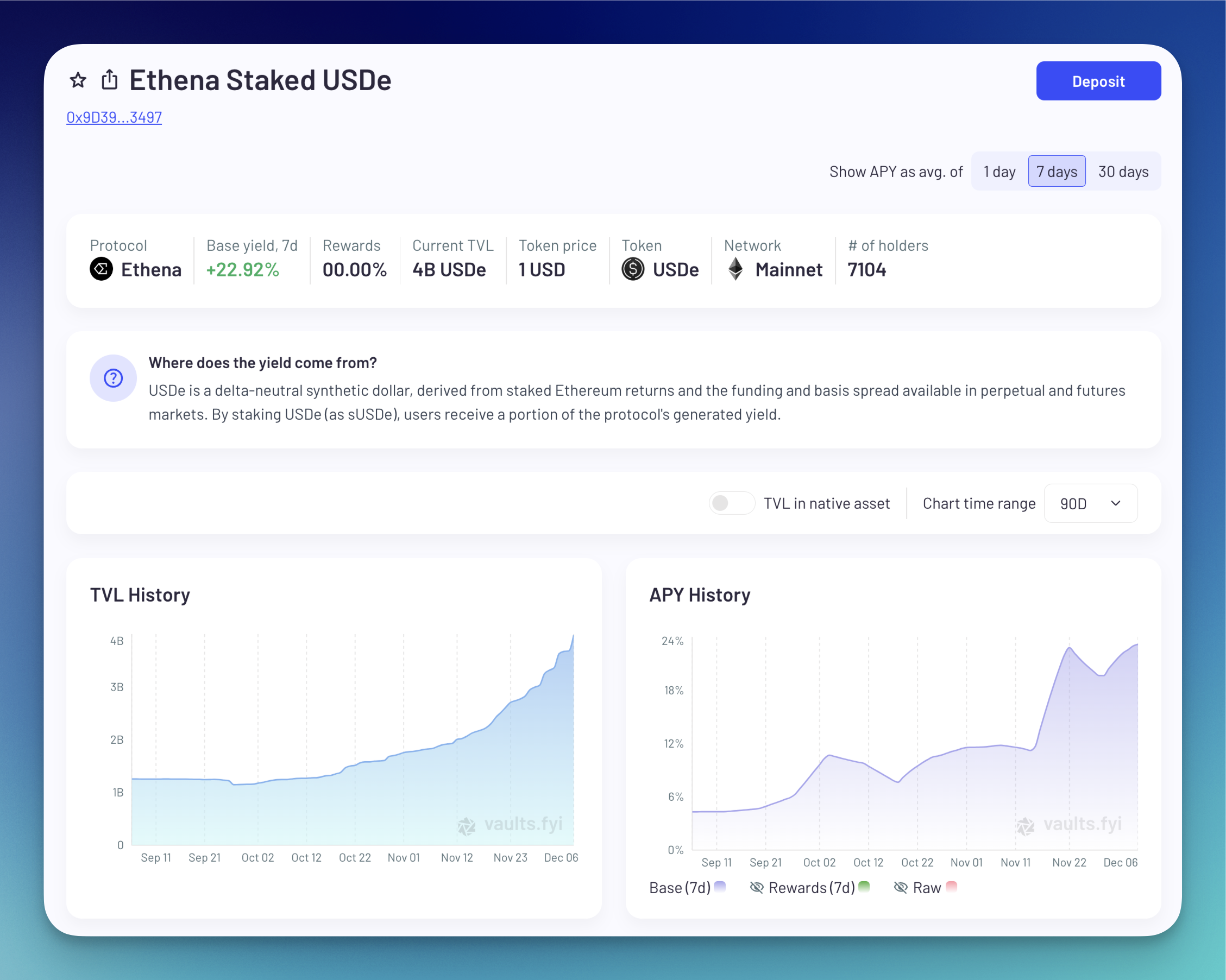

Nevertheless, USDe’s parabolic rise in TVL shows no signs of slowing down. Out of all vaults tracked on vaults.fyi, USDe is now the 4th largest vault and the largest USD vault with ~4B in TVL. Despite this, USDe maintains an impressive APY of 22.92%, making it one of the most lucrative opportunities in DeFi.

Blue-chip DeFi USD rates are approaching their peak last seen in March earlier this year. vaults.fyi’s USD benchmark rate, the weighted average of the vaults shown below, is currently at 13.12%. We’re so back, anyone?