October Changelog

Check out our new network-specific benchmark yields, Solana API endpoints, and features around curators.

This past month we shipped features that give our app and API users more transparency into the vaults we integrate, along with unique market-level data like network-specific benchmark yields. Read on for more detail.

New Analytics

Available now at https://app.vaults.fyi/analytics.

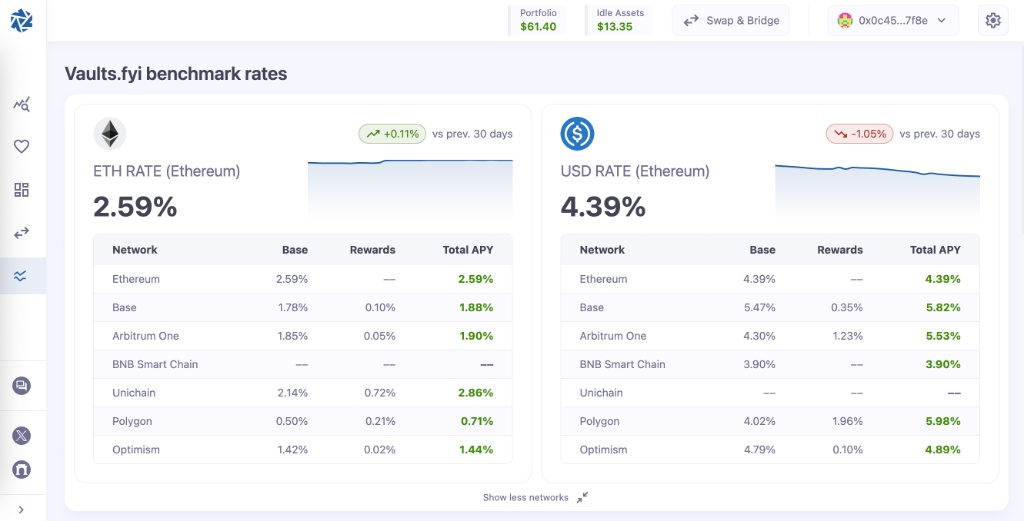

Benchmark Rates by Network

You can now see composite lending rates (TVL-weighted APY) for each network. This makes it easy to track market-wide performance and compare yield opportunities across different chains. The dashboard shows current rates and historical trends, available for 1-day, 7-day, and 30-day averages.

For developers, current and historical benchmark data is available through our API via the /v2/benchmarks/{network} and /v2/historical-benchmarks/{network} endpoints.

Best Performing Vaults

Also on the new Analytics page, you can track vault share price performance over various time ranges (30, 90, 180, and 365 days). This helps to identify top historical "real yield" performers and gives a clear view into a vault's appreciation over longer time frames.

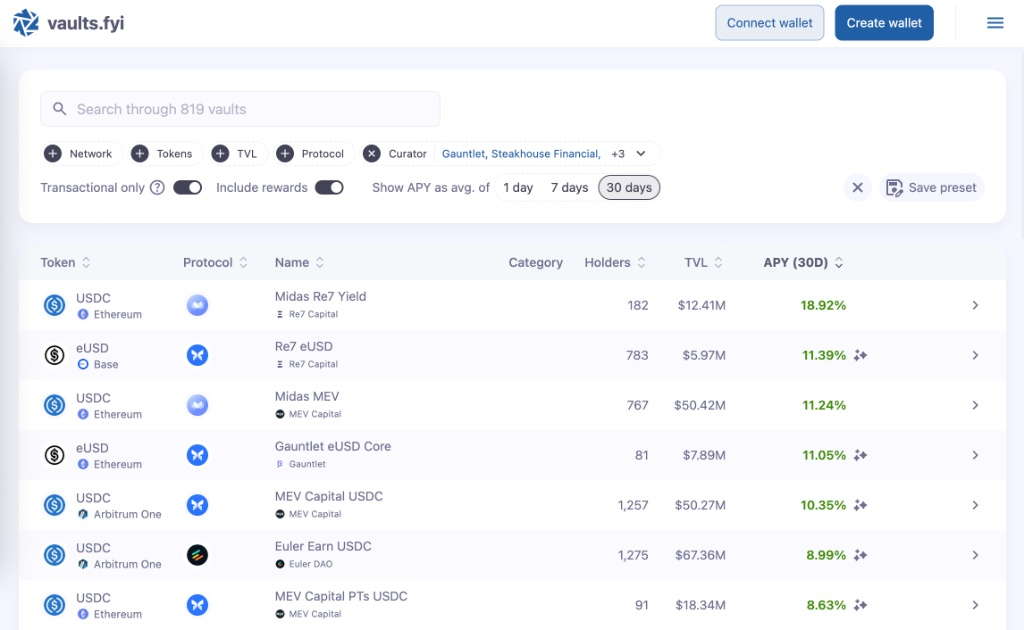

Vault Curator Features

Realizing that lenders need a deeper view into vaults, we’ve made it easier to identify which vaults are managed by curators or risk managers.

Our app and API clearly label each applicable vault with its curator. This allows app users and developers via our API to filter opportunities by specific curators, such as Gauntlet, Steakhouse Financial, kpk and more.

Look for us to add more data around curators and vault risks in November.

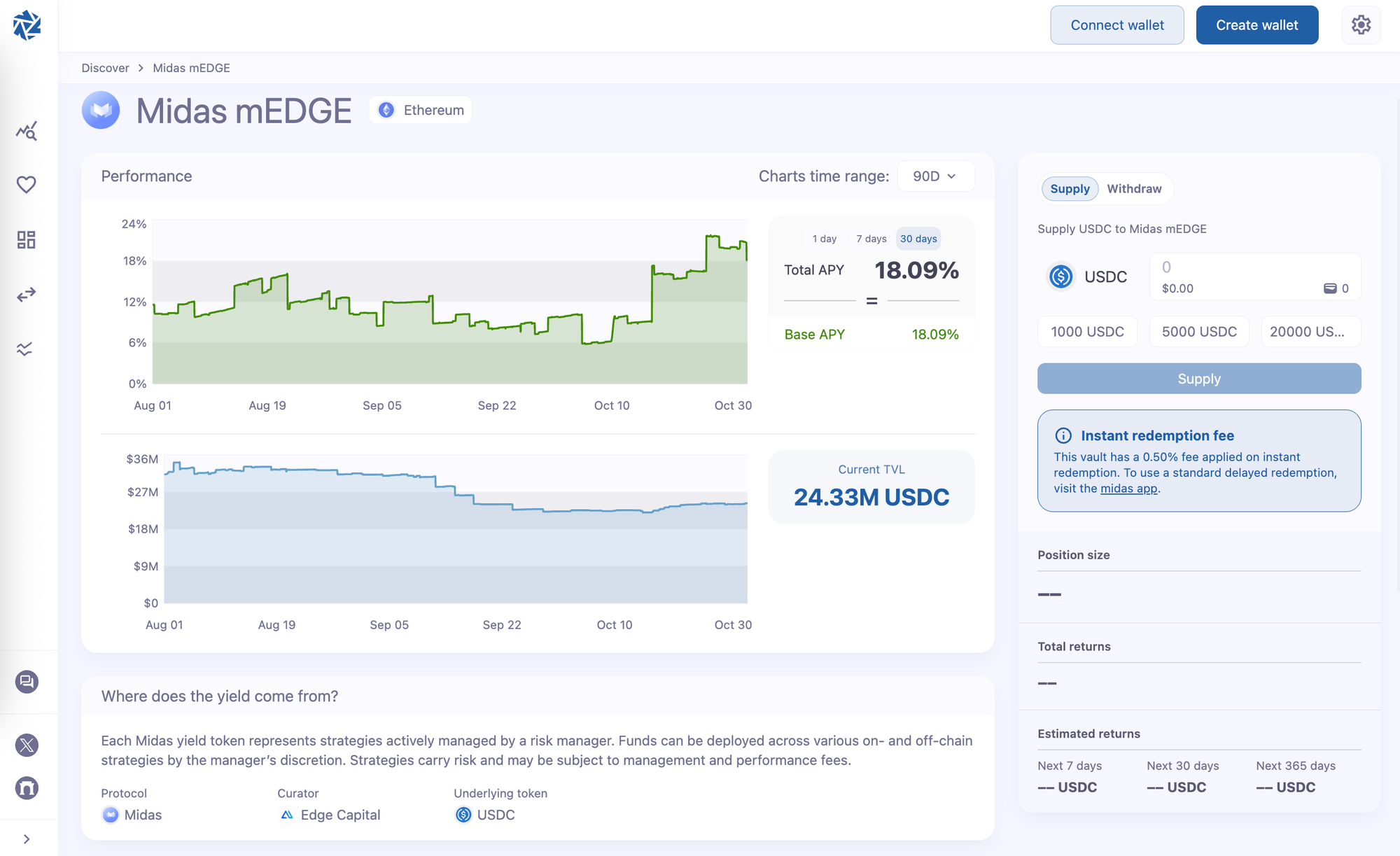

Improved Fee & Withdrawal UX

We improved how we show redemption fees and withdrawal queues in our app. For example, before a user interacts with Midas vaults, they will see fees applicable to instant redemptions, along with the option to use delayed redemptions. This makes understanding the costs and timeframes of withdrawals clearer than ever.

New Integrations

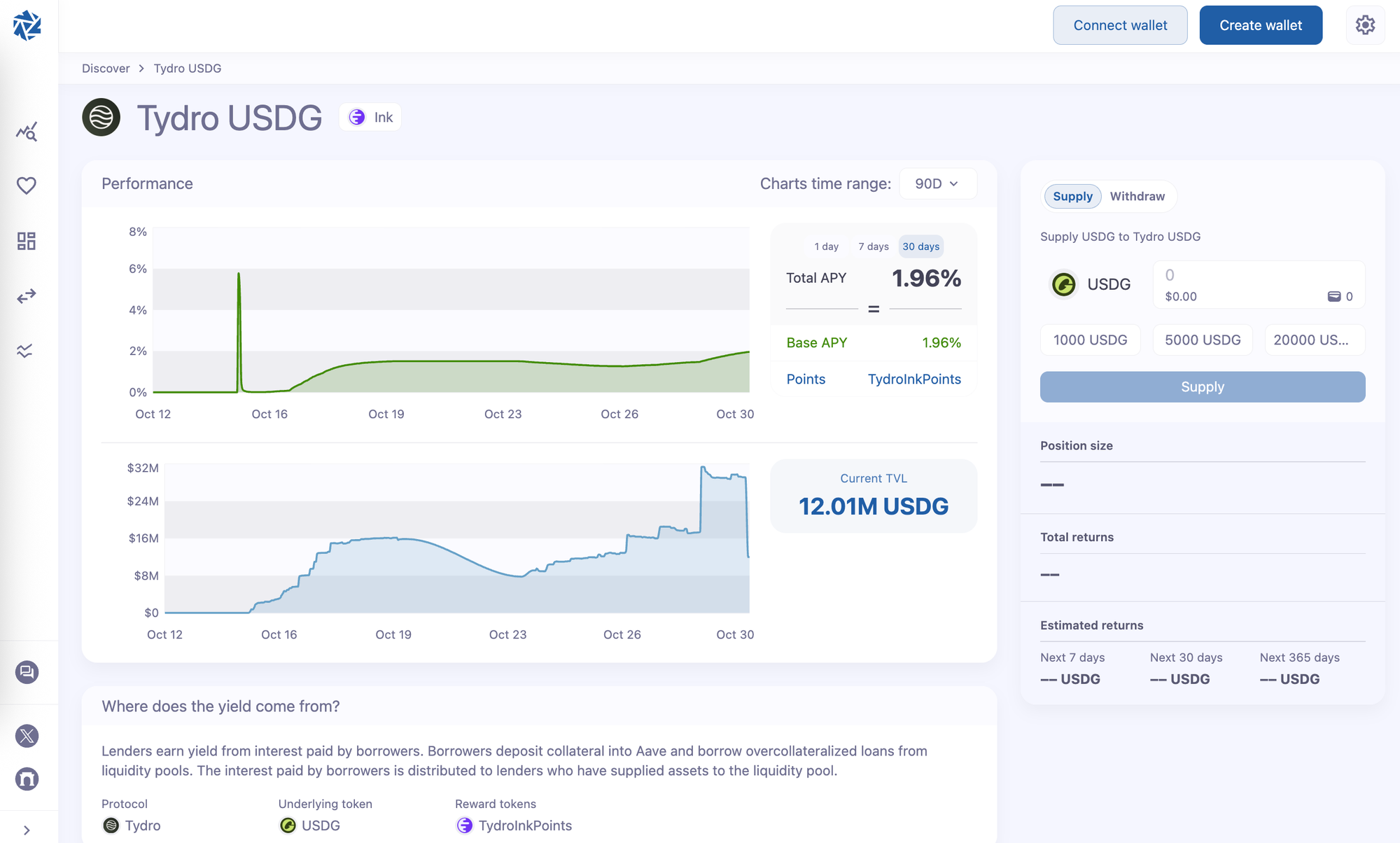

We've also added support for many new vaults and networks. To highlight our latest ones, we added support for Tydro markets on Ink and Cap USD on Ethereum.

Beta Support for Solana

We've added beta support for Solana yields and position tracking, starting with Jito and Drift.

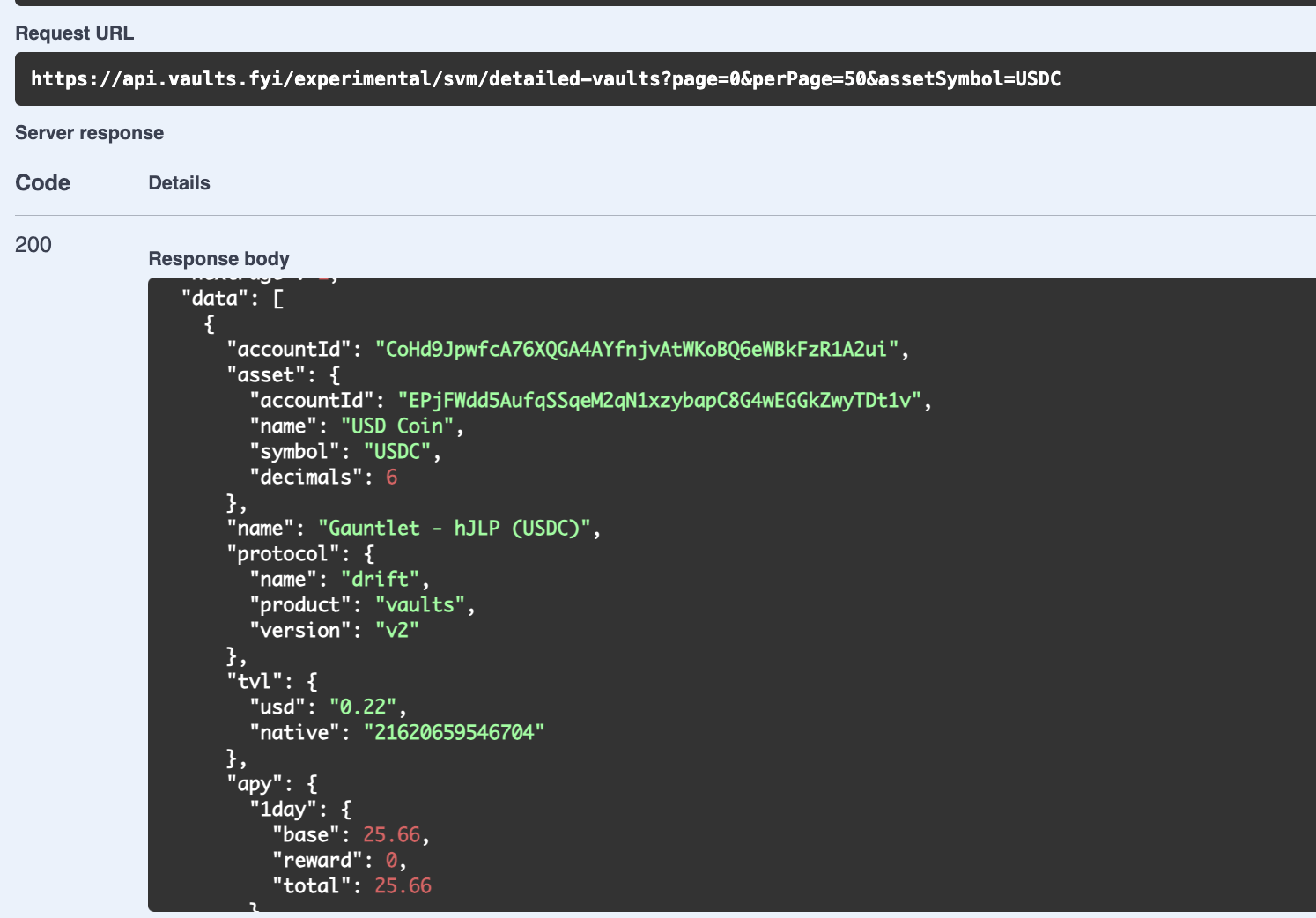

These are currently available to explore via our Experimental API, giving developers early access to build with Solana yield data.

You can find the documentation here: https://api.vaults.fyi/experimental/documentation/static/index.html#/

Check out /experimental/svm/detailed-vaults to find yield opportunities across Jito, Drift, and more protocols coming soon™ for your favorite assets such as USDC and SOL.

That’s all for October! Head over to the app to check out the new features. As always, let us know what you think.