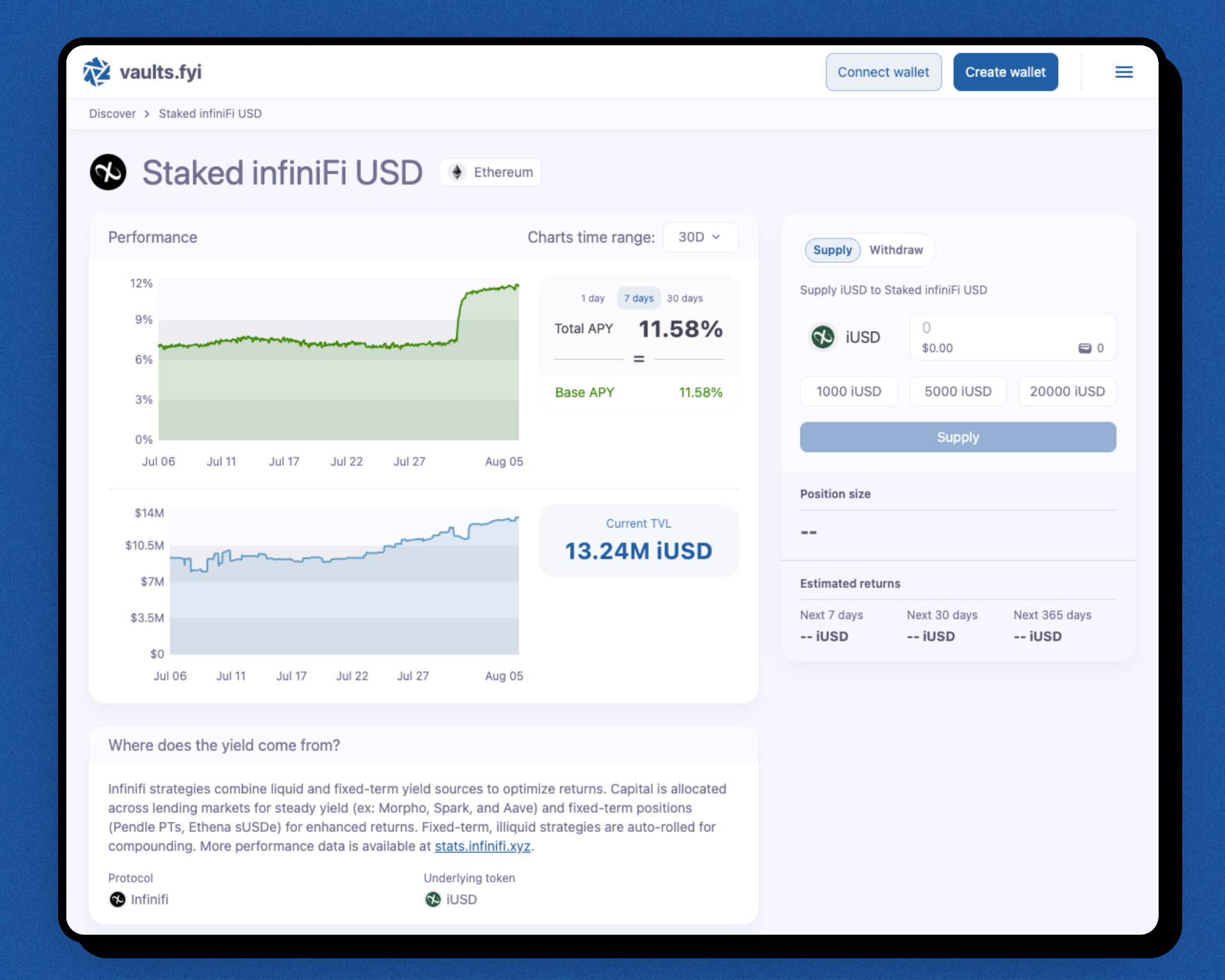

infiniFi Now Live on vaults.fyi

We’re excited to announce that infiniFi is now integrated on vaults.fyi, with full analytics and transactional support for Staked infiniFi USD (siUSD).

This integration brings infiniFi’s high-efficiency stablecoin yield vaults into the vaults.fyi ecosystem, enabling onchain users to analyze, compare, and interact with infiniFi vaults directly through our interface and API.

What is Staked infiniFi USD?

Staked infiniFi USD (siUSD) is a yield-generating stablecoin product. Users who stake iUSD earn a dynamic yield generated by a combination of liquid lending strategies and fixed-term positions.

infiniFi dynamically allocates capital depending on whether users stake or lock their iUSD:

- For liquid holdings (iUSD and siUSD) target allocations are:

- 60% in fixed-term strategies like Pendle PTs and Ethena

- 40% in liquid lending protocols such as Morpho, Spark, and Aave

- For locked holdings (liUSD-1week to liUSD-13week):

- 100% is deployed into higher-yield, fixed-duration strategies

All vault strategies are fully transparent and verifiable at: 📊 stats.infinifi.xyz

What’s available on vaults.fyi?

With this integration, vaults.fyi users can:

- ✅ View live TVL, APY, and historical yield for Staked Ininifi USD (siUSD)

- ✅ Track siUSD positions alongside other DeFi assets

- ✅ Compare infiniFi yields with other stablecoin strategies

- ✅ Supply and withdraw directly through the vaults.fyi app and API

Start exploring here: 🔗 Infinifi vaults on vaults.fyi

Why this matters

infiniFi is building a flexible, capital-efficient stablecoin yield system that blends liquid and fixed-term DeFi strategies. With this integration, vaults.fyi users can tap into those yield streams more easily and developers can build on top of it via our API.

Is there a vault or protocol you'd like us to support next? Let us know.

1/ 🎉 Introducing the @vaultsfyi app — discover yields, deposit funds, and track positions in one place.

— vaults.fyi (@vaultsfyi) January 16, 2025

Connect your wallet and start earning from top DeFi protocols in under 60 seconds.

Fully non-custodial with no wrappers or extra smart contracts — just yield 🧵 pic.twitter.com/3py6OQtpMK